December 2025 SEBI F&O Rule Changes: The Complete Guide Traders Can’t Afford to Miss

Introduction: December 2025 Is a Turning Point for India’s Traders

December 2025 marks the final activation of SEBI’s new F&O reforms. This regulatory overhaul will permanently transform how India trades index options, index futures, and single stock derivatives.

If you are a retail trader, options seller, algo trader, proprietary desk, or even a long-term investor, these rules will directly affect your costs, limits, liquidity levels, and intraday trading behaviour starting from 3rd and 6th December IST.

This is not just an update.

It changes the trading environment itself.

Your old playbook will not work the same way going forward.

Traders who ignore these reforms may face penalties, reduced trading edge, or surveillance restrictions.

This guide breaks down the exact changes and how traders must prepare.

1. Hard Limits for Index Options Effective 6 December 2025

This is the most impactful and strict rule SEBI has introduced for index derivatives.

Until 5 December, traders receive a one day grace period known as the glide path. They can adjust excess delta positions on the next day.

From 6 December 2025, this buffer is removed completely. Compliance must happen on the same day.

Mandatory Position Limits

Net FutEq OI limit: ₹ 1,500 crore

Gross long delta limit: ₹ 10,000 crore

Gross short delta limit: ₹ 10,000 crore

Consequences of Breaching These Limits

If a trader exceeds the limits after end of day delta calculations:

Additional Surveillance Deposit may be imposed

Exchanges may freeze or block further exposure

Repeated breaches may trigger enhanced surveillance

Traders Most Affected

Index options sellers

Expiry day traders

Proprietary desks

Scalpers taking large exposures

Algo platforms running multi-leg strategies

High volume institutions

This rule pushes the market toward disciplined, delta-aware and risk-monitored trading.

2. Pre Open Session for Futures Begins 6 December 2025

SEBI is introducing a pre open session for futures trading for the first time in India. This aligns futures behaviour more closely with the equity cash market.

Instruments Included in Pre Open

Current month index futures

Current month stock futures

During the last five days before expiry:

Next month futures also join pre open due to rollover activity.

Why This Change Matters

More accurate opening price discovery

Reduced volatility at market open

Lower slippage for algorithmic and institutional orders

Smoother liquidity patterns

Better protection for retail traders

This change improves the quality of market signals for AI based trading, automated bots and quant systems.

3. Intraday MWPL Surveillance Effective 3 December 2025

Earlier, MWPL (Market Wide Position Limit) was checked only at end of day. That now changes entirely.

Stock Exchanges Must Now

Run at least four random intraday MWPL checks

Monitor delta adjusted OI using FutEq calculations

Flag abnormal concentration of positions

Apply Additional Surveillance Margin immediately if needed

Report repeated breaches to SEBI during surveillance meetings

Issues This Reform Reduces

Manipulation

Short lived artificial price spikes

Unnecessary F&O bans

Excessive exposure in low liquidity stocks

Algo Traders Must Update

Real time MWPL tracking

Automatic order blocking near thresholds

Delta recalculation logic

Intraday exposure throttles

This is one of the largest forced upgrades for the retail and proprietary algo ecosystem in India.

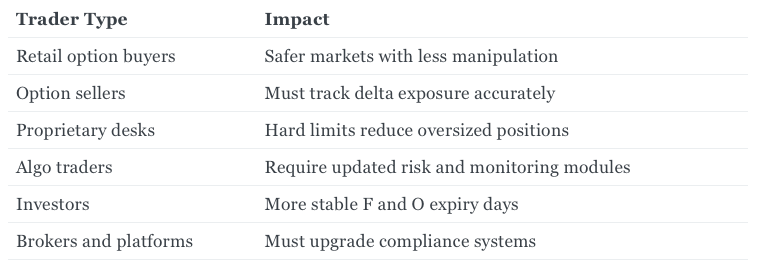

What Will Change for Different Types of Traders

Checklist: How to Prepare Before 3rd and 6th December

- Install a delta monitoring system with real-time FutEq OI calculations.

- Update algo guards to include exposure throttles, OI based blocking and MWPL based triggers.

- Stop using high leverage expiry day strategies likely to breach new limits.

- Backtest strategy behaviour during the pre open window from nine to nine fifteen AM IST.

- Maintain an additional margin buffer to avoid sudden Additional Surveillance Deposits.

- Follow SEBI and exchange updates every week during December as more clarifications may be issued.

Scenario Analysis: A Practical Example

Consider a proprietary desk running large index straddles.

Old behaviour:

The desk could exceed exposure temporarily and reduce positions the next day without penalty.

New behaviour starting December:

The same straddle may cross the net or gross delta thresholds.

The desk must reduce positions on the same day.

Failure to reduce exposure will trigger penalties and enhanced surveillance.

The conclusion is simple.

Either reduce trading size or upgrade risk systems to stay compliant.

Frequently Asked Questions About SEBI’s December 2025 Rules

1. Do these rules affect retail traders

Most retail traders will not reach the new limits unless they trade unusually large lot sizes.

2. What is FutEq OI

It is the delta adjusted open interest measurement used by SEBI. It converts options and futures exposure into a standardised futures equivalent format.

3. Will expiry volatility change

Yes. With stronger checks and limits, expiry sessions are expected to become more stable.

4. Do algorithmic systems require updates

Yes. Delta tracking, MWPL based triggers and pre open logic must be upgraded immediately.

5. Are penalties immediate

After 6 December, penalties apply on the same day if limits are breached.

Why SEBI Introduced These Reforms

SEBI aims to build a safer and more globally aligned derivatives ecosystem.

Key objectives include:

Better risk management

Higher transparency

Protection for retail traders

Reduced expiry day instability

Institutional grade market structure

The December phase is the strictest part of the entire reform cycle.

Final Takeaway

December 2025 brings the final and most significant phase of SEBI’s new derivatives regulations. Traders must update their risk systems, delta tracking tools, and algo logic before 3rd and 6th December IST.

References

Firefly Platform Overview

https://www.fintrens.com

Firefly Documentation

https://docs.firefly.fintrens.com

Fintrens Join Page

https://www.fintrens.com/join

Fintrens WhatsApp Channel

https://whatsapp.com/channel/0029VackYjRLdQegrpD4uj2T

NSE Circular:

https://nsearchives.nseindia.com/content/circulars/FAOP69898.pdf