💰 Gold ETF + Algo Trading: How a Smart Investor Doubled His Wealth in 12 Months

🌟 The Story of Raghav — Turning Gold into a Wealth Machine

Most investors buy gold and keep it locked.

But Raghav, a disciplined investor from Bengaluru, thought differently.

In early 2024, with gold prices surging, he decided not to buy jewellery but to purchase Nippon India ETF Gold BeES — a SEBI-regulated exchange-traded fund that mirrors gold’s price on NSE and BSE.

That single decision set the stage for an extraordinary 12-month wealth compounding journey.

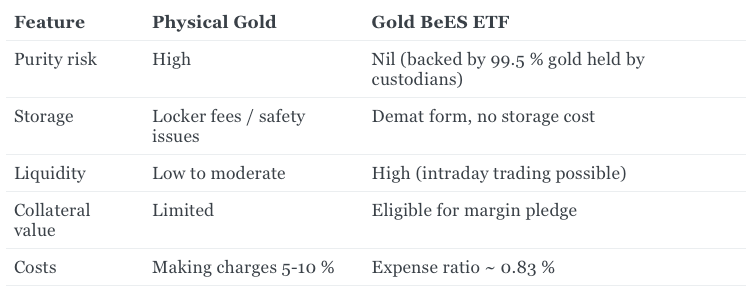

🟡 Why Smart Investors Use Gold BeES for Trading Margin

Gold BeES (Benchmark Exchange Traded Scheme) represents 1/100th gram of gold per unit.

It combines the convenience of stock-market trading with the intrinsic value of physical gold.

When Raghav entered in early 2024, gold traded near ₹ 5 800 / g.

By mid-2025 it crossed ₹ 7 000 / g, giving him roughly 20 % appreciation — without lifting a finger.

⚙️ How He Used Gold BeES as Collateral

Instead of selling his ETF (and triggering taxes), Raghav pledged his Gold BeES units with his broker.

That unlocked trading margin while the gold investment remained intact.

He channelled this margin into Firefly by Fintrens — an algorithmic trading bot that executes rule-based strategies automatically.

Firefly eliminated emotional decisions and ensured every trade followed pre-tested logic.

No late-night chart stress. No impulse buying. Just data and discipline.

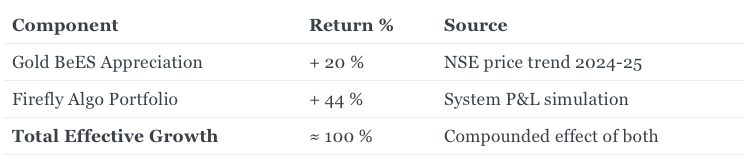

🚀 Gold + Algo Trading = Compounding Magic

During the same year:

By June 2025, Raghav’s net worth had doubled — his gold kept appreciating while his algo portfolio compounded returns.

That’s not luck. That’s smart investing — using assets as tools, not trophies.

🧠 Understanding Gold BeES & Silver BeES

🔸 Nippon India ETF Gold BeES

- India’s first gold ETF (2007)

- 1 unit = 1/100 gram gold

- Fully backed by physical bullion

- Expense ratio ≈ 0.83 %

- Ideal for inflation hedge & digital SIP

🔸 Nippon India ETF Silver BeES

- India’s first silver ETF

- Tracks domestic silver prices (London Fix + import duty)

- Exposure to industrial metals for EV & solar sectors

- Adds diversification beyond gold

Together, they create a balanced precious-metal hedge with liquidity + collateral potential — perfect for investors who want stability and growth.

💡 Why Firefly by Fintrens Transforms Trading

Firefly connects directly with your broker API to:

- Automate entry / exit rules based on tested strategies

- Back-test on historical data before deployment

- Monitor real-time P&L and risk ratios

- Stay within SEBI-approved automation guidelines

Pairing Firefly with Gold BeES means your gold works twice — earning returns while powering your trades.

🔍 5 Common Mistakes When Pledging Gold BeES

- Ignoring Margin Haircuts: Brokers usually offer 70–90 % of ETF value as margin. Failing to account for haircut can cause shortfalls.

- Pledging During Volatile Weeks: Gold prices swing with USD movements; pledge during stable weeks to avoid MTM calls.

- Not Un-pledging Before Selling: You must un-pledge before liquidation; else settlement delays occur.

- Over-leveraging: Never use entire collateral value for trading. Maintain buffer margin (15-20 %) for safety.

- Ignoring Tax Records: Pledge does not trigger tax, but trading profits do — record everything for IT filings.

Avoiding these mistakes keeps the strategy SEBI-compliant and risk-managed.

🧾 Tax Implications of the Strategy

Understanding tax impact is crucial before replicating Raghav’s plan.

1. Gold BeES Capital Gains

- Short-term (< 36 months): Taxed as per individual slab.

- Long-term (> 36 months): 20 % with indexation benefit.

Raghav held for ~18 months → short-term gain.

2. Algo Trading Profits

- Classified as business income under “non-speculative trading.”

- Taxed as per slab rate (plus audit if turnover > ₹ 10 cr).

- Expenses like brokerage, software, and Firefly subscription are deductible.

3. GST & TDS Considerations

- Algo fees attract 18 % GST when billed by registered entity.

- No TDS on pledged margin unless interest is earned.

4. Best Practices

- Maintain separate ledger for trading activity.

- Use CA-certified accounting software to auto-reconcile broker statements.

- File ITR-3 (Income from Business & Profession).

❓ Frequently Asked Questions

Q1. What is Gold BeES ETF and how does it work?

It tracks the domestic gold price via units listed on NSE/BSE; each unit equals 1/100 gram of gold.

Q2. Can I pledge any ETF for margin trading?

No, only select ETFs like Gold BeES are approved by brokers for margin collateral.

Q3. Is algorithmic trading legal in India?

Yes, under SEBI’s API and exchange guidelines through registered brokers.

Q4. Expected returns?

Rule-based strategies target 30-40% annually with strict risk controls; results vary.

- ⚡ Join Firefly : www.fintrens.com/join

- Know more about Firefly : www.fintrens.com

- 🚀 Join 1,000 + Smart Investors Using Firefly → Start your journey today.

🧭 Final Takeaway

Raghav’s story isn’t about luck or timing.

It’s about discipline, diversification, and data-driven execution.

Gold gave him stability; Firefly gave him momentum.

Together they delivered financial freedom — the new definition of Smart Investing India.

✨ Smart Investor. Smart Gold. Firefly by Fintrens.

🌐 www.fintrens.com 📘 docs.firefly.fintrens.com 💬 WhatsApp Channel 🚀 Join Now

⚠️ Important Disclaimer

This article is for educational purposes only and does not constitute investment advice.

Past performance does not guarantee future results.

Trading in securities and derivatives involves risk, including possible loss of principal.

Readers are encouraged to consult a SEBI-registered financial advisor before acting on any information mentioned here.