How to Choose the Best Broker API for Algo Trading in India

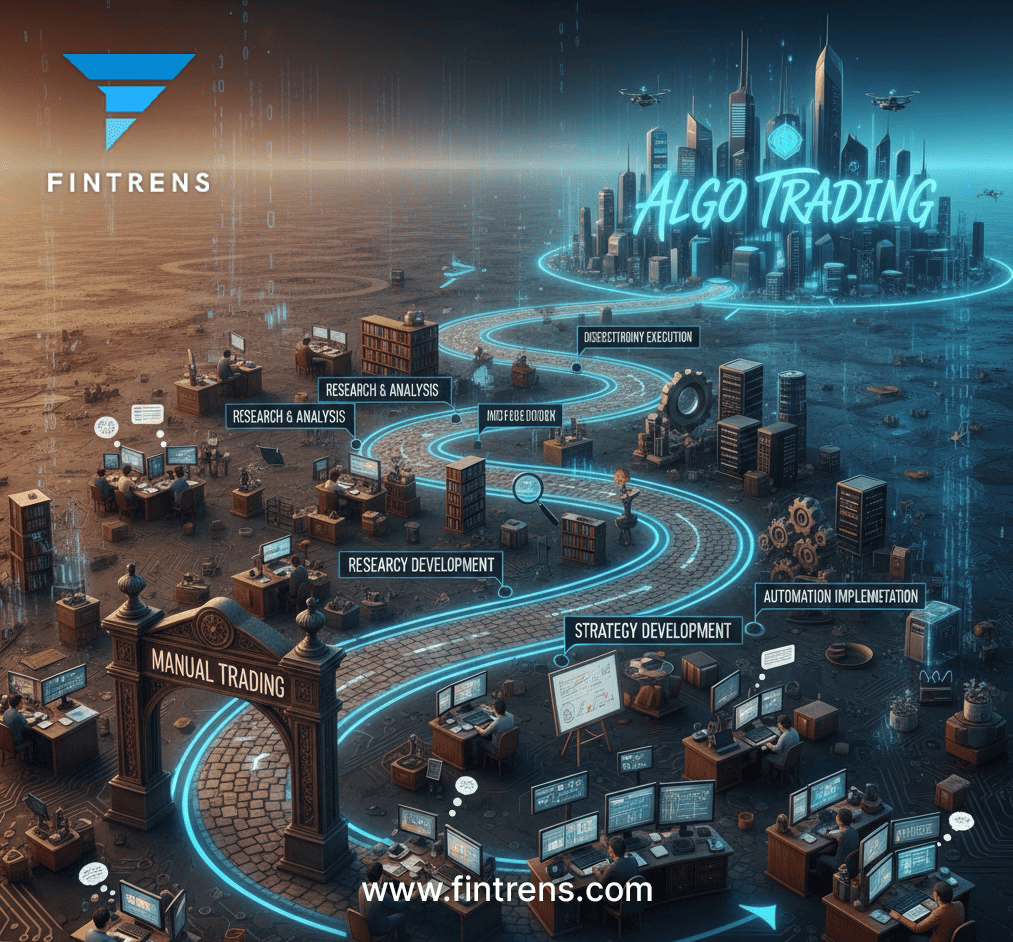

In today’s fast-paced financial markets, algorithmic trading is no longer reserved for big institutions. With the rise of API-based stock trading in India, retail traders now have access to powerful tools that automate strategies and execute trades seamlessly.

But here’s the challenge — your success in algo trading heavily depends on selecting the right broker API.

Whether you're using an automated trading bot, building your own system, or exploring no-code algo trading platforms, this guide will help you choose wisely.

🚀 Why the Right Broker API Matters in Algorithmic Trading

Your algo trading app communicates with the stock market through a broker’s API. This API controls everything—order placement, market data access, portfolio updates, and more.

A poor choice can lead to:

- Missed trades due to API downtime.

- Data inconsistencies affecting strategy performance.

- Manual interventions breaking automation.

That’s why selecting the best API for algo trading in India is critical.

✅ Key Factors to Consider When Choosing a Broker API

1. Open API Access for Stock Market Automation

Ensure the broker provides a robust, well-documented open API that supports:

- Order execution & management

- Real-time market data feeds

- Historical data for backtesting

- Portfolio & position tracking

Without open API access, your automated trading bot cannot function effectively.

2. API Stability, Uptime, and Reliability

A stable connection is the backbone of any automated trading strategy.

- Look for brokers with high API uptime percentages.

- Test for session stability during long backtests.

- Check if the API handles high-frequency requests within allowed rate limits.

🔹 Pro Tip: A reliable API ensures your trades are executed without unexpected disconnections.

3. Session Management & Automated Login Options

For true trading automation, manual logins should be avoided.

- Does the API support automated login flows (like token-based or TOTP)?

- Are there restrictions on multiple sessions?

- Does logging into the broker’s web app disconnect your trading bot?

Efficient session handling is crucial for uninterrupted intraday trading automation in India.

4. Real-Time Data Accuracy & Position Updates

- Ensure access to live tick data with minimal latency.

- Some APIs refresh P&L data every few minutes instead of real-time—this can disrupt scalping or intraday strategies.

- Watch for common issues like websocket disconnects during market volatility.

Accurate data feeds are essential for any AI-based stock trading or quant-based investment strategies.

5. Historical Data Depth for Backtesting

Robust backtesting requires deep, reliable historical data.

- Some APIs offer up to 10 years of historical data.

- Check if they provide minute-level candles or just daily summaries.

- Confirm if they cover options data, indices, or only equities.

If needed, combine data sources across brokers—but ensure synchronization in your API-based stock trading system.

6. API Pricing, Payment Flexibility & Access Management

- Some brokers offer free APIs, while others charge monthly.

- Look for auto-deduction options from your trading account to avoid service interruptions.

- Modern brokers provide dashboards to generate, update, or revoke API keys—avoid outdated manual processes.

Choosing a broker with seamless API management supports long-term wealthtech automation.

⚠️ Common Pitfalls in Broker APIs

Before finalizing your choice, watch out for:

- Frequent live tick websocket disconnects

- Single session restrictions causing accidental logouts

- Manual daily login requirements

- Delayed or inconsistent market data

- Poor developer support

These issues can severely impact your data-driven investing approach.

🎯 Conclusion: Building a Strong Foundation for Algo Trading Success

Selecting the right broker API is more than a technical decision—it’s a strategic move towards reliable, scalable stock market automation.

Here’s your quick checklist:

- ✅ Open API with full market access

- ✅ Proven stability and uptime

- ✅ Automated session handling

- ✅ Real-time, consistent data

- ✅ Deep historical data coverage

- ✅ Transparent pricing with easy management

For anyone serious about smart investing solutions and automated trading bots, this decision lays the groundwork for success.

🔗 Explore Firefly – Your Partner in Automated Trading

Looking for an enterprise-grade algo trading solution?

Meet Firefly — a black-box algo designed for:

- Scalable and secure trading automation

- Intelligent handling of broker APIs

- Real-time market behavior analysis using AI and swarm intelligence

👉 Learn more at www.fintrens.com

📄 Explore Firefly Documentation: docs.firefly.fintrens.com

📲 Join our WhatsApp Channel for updates: Click Here