I Made ₹3,00,000 While My Flight Was Delayed: The Power of “Set Once, Execute Always”

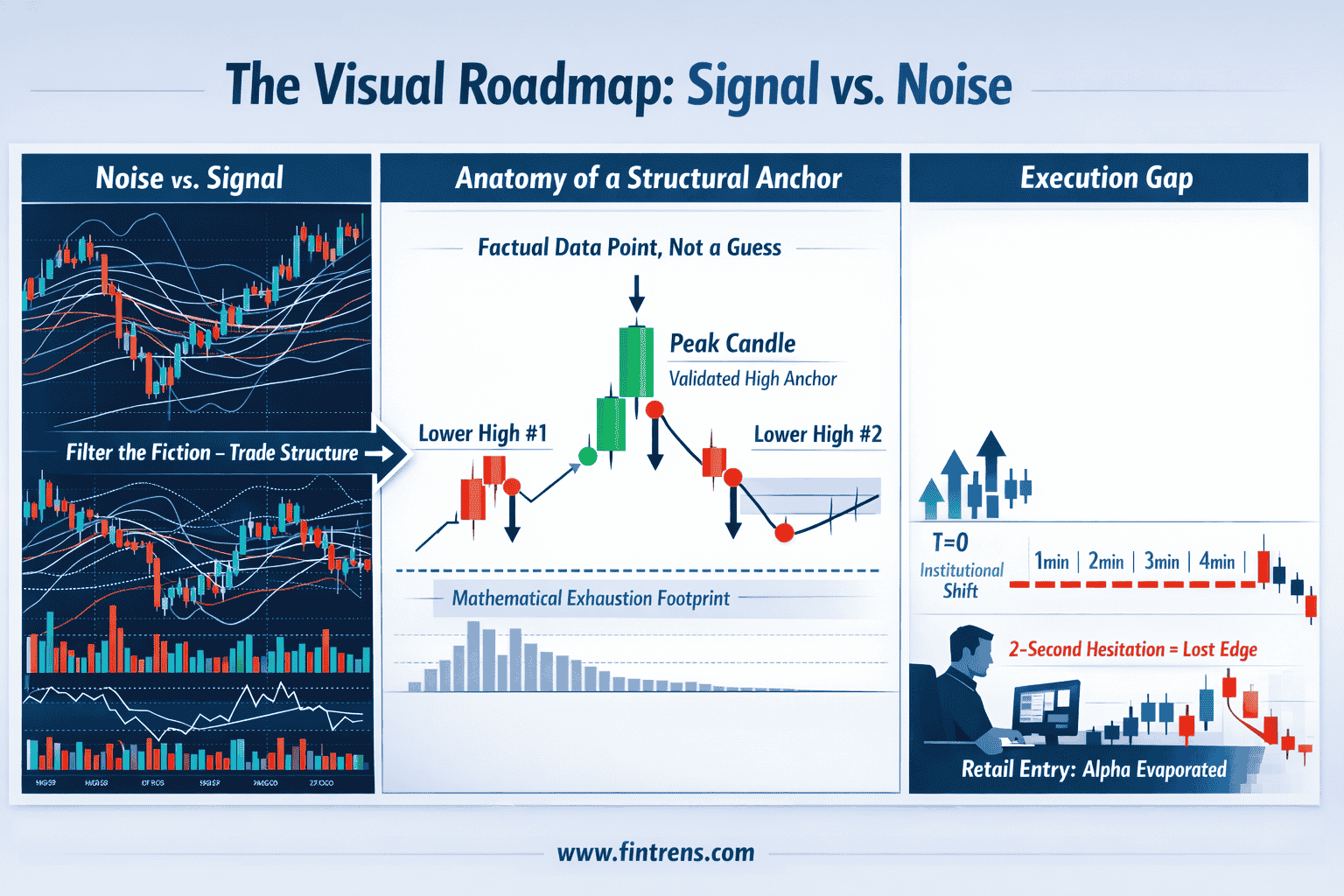

There is a popular image of trading that refuses to die: fast fingers, multiple screens, 1-minute candles flashing red and green, breaking news alerts, and a trader glued to the screen ready to act at any second. It looks impressive and feels heroic. It’s the version of trading Hollywood loves to show us. But in reality, it is also why most traders lose.

This is a story about the opposite approach. Instead of staring at charts, I was standing in a crowded airport terminal. Instead of reacting to price, a system was executing. Instead of emotion, there was engineering. By the time my flight finally took off, a trade had completed its full lifecycle—entry, target hit, exit done—profit: ₹3,00,000.

This didn't happen because of luck or a moment of genius. It happened because the decisions were made long before the market moved.

The Trap of the “Hero Trader”

Most traders fail for a simple reason: they believe they need to be the hero of the story. They think their edge comes from a combination of:

- Being online the exact moment the market opens.

- Having a “gut feeling” about a breakout.

- Watching price ticks and news feeds relentlessly.

- Reacting faster than everyone else in the room.

That isn’t an edge. It’s a liability. If your strategy requires you to be emotionally neutral, perfectly alert, and physically present at all times, you don’t have a trading business. You have a high-stress job where the market is your boss—and it is a boss that fires people without notice or severance.

Human availability is fragile. Human emotions are unreliable. Markets are designed to exploit both. When you are sitting in front of a screen, you aren't just looking at data; you are battling your own biology.

Decide Early. Execute Late.

At Fintrens, we operate on a simple philosophy: Make decisions when you are calm so execution can happen when the market is chaotic. When you’re inside a live trade, your brain isn’t logical—it’s chemical. Your body is flooded with hormones that were designed for survival, not for managing a portfolio:

- Dopamine pushes you to overstay your welcome in a winning trade, chasing a "jackpot" that often turns into a reversal.

- Cortisol (the stress hormone) pushes you to exit early at the first sign of a minor pullback, causing you to miss your actual target.

This is the worst possible moment to decide anything. To combat this, we invert the entire workflow. We do the heavy lifting when the markets are closed or when we are away from the heat of the candles.

The Systematic Approach: Rules Over Reflexes

In a systematic world, the process is clinical. We follow a strict hierarchy that removes the "Human Element" from the moment of execution:

- Logic is defined outside market hours: We create our rules when screens are off and emotions are quiet.

- Risk is fixed before entry: You should never be calculating your risk while you are staring at a flashing "Buy" button.

- Loss tolerance is known before the trade exists: If the trade fails, we already know the cost. It’s a business expense, not a tragedy.

- No mid-flight changes: Once the market moves, there’s nothing left to decide. You either hit your stop, or you hit your target.

By the time the trade triggers, execution becomes mechanical. Emotion becomes irrelevant.

What Happened While I Was Offline

While I was waiting at the gate, dealing with the frustrations of travel and spotty airport Wi-Fi, three things happened—all without my intervention.

- The Zone

Price entered a predefined buy zone that had been identified days earlier through structural analysis. While I was looking for a boarding pass, the system was looking at the level. - The Filter

The system validated volatility and market structure. This wasn’t just "noise" or a random spike—it was a qualified setup that met every single one of my pre-set criteria. - The Execution

There was no hesitation. No second-guessing. No wondering "what if the news is bad?" The conditions matched the math. The order executed.

By the time I regained Wi-Fi at 30,000 feet, the trade had already completed its full lifecycle. Entry. Target hit. Exit done. The ₹3,00,000 was sitting in the account before I even had my first cup of coffee on the plane.

Why Automation Isn’t About Speed

People often assume automation is about being faster than humans—like a high-frequency trading firm. That’s not the real edge for the individual trader. The real edge is discipline.

| Feature | Manual Trading | Systematic (Firefly) |

|---|---|---|

| Consistency | Mood-dependent | Same rules, every time |

| Availability | Needs you online | Operates without fatigue |

| Emotion | Fear & greed | Zero emotion |

| Repeatability | Low | High |

In the world of professional trading, speed is optional. Discipline is not. A system doesn't get tired, it doesn't get "revenge" after a loss, and it doesn't get overconfident after a win.

The ₹3,00,000 Isn’t the Point

The amount makes a good headline, but it’s not what actually matters. Any single trade—win or loss—is statistically irrelevant in the grand scheme of a trading career.

What does matter is this: The system behaved exactly as designed. That is the real outcome. Trading success doesn’t come from one heroic moment where you "called the bottom." It comes from building a process so boring, so consistent, and so repeatable that profits emerge as a byproduct of your engineering—not a coincidence of your luck.

Firefly: Logic That Stays in the Market

We built Firefly for traders who don’t want their performance tied to screen time, emotional discipline, or perfect availability. It is designed around one core idea: Set the logic once. Let the system execute always.

While you’re traveling, working, or simply living your life, the logic remains active. It is in the market, even when you aren't. It is enforcing rules, managing risk, and executing with the same cold discipline every single time.

Markets reward preparation, not presence. If your edge disappears the moment, you step away from your desk, the problem isn’t the market. It’s the process.

Firefly by Fintrens — built for systematic traders.

Start:

https://www.fintrens.com

Understand the engine:

https://docs.firefly.fintrens.com

Stay in sync (real-time updates):

https://whatsapp.com/channel/0029VackYjRLdQegrpD4uj2T

Be part of the community:

https://www.fintrens.com/join

Disclaimer: This content is for educational and informational purposes only and does not constitute financial, investment, or trading advice. Trading in financial markets involves significant risk, including the potential loss of capital, and is not suitable for everyone. Any profit figures or examples mentioned are illustrative and not a guarantee of future performance; actual results may vary due to market conditions, execution factors, and individual risk management. Always do your own research and consider consulting a qualified financial professional before making any trading or investment decisions.