Is Your Strategy Failing? Why Old-School Indicators Are Lagging in Today’s Fast Markets

The stock market today is a completely different beast than it was even five years ago. It’s faster, more aggressive, and dominated by high-speed technology. If you’re still using the same old tricks from the classic textbooks—like waiting for two lines to cross on a chart—you’ve probably noticed they don’t work like they used to.

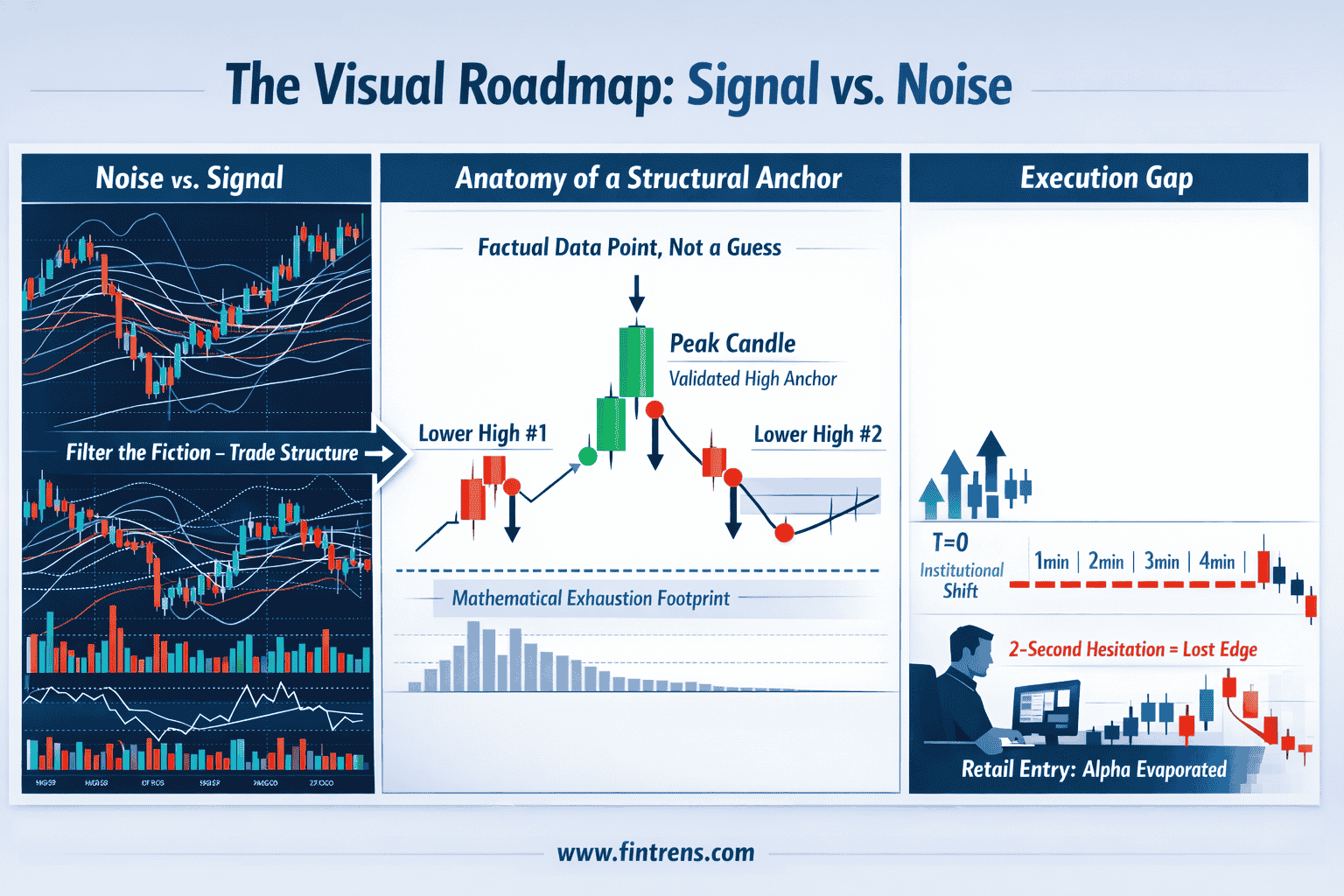

In fact, you might feel like every time you enter a trade, the market immediately moves against you. You aren't imagining it, and you aren't a "bad" trader. You’re just using an old map to navigate a city that was rebuilt last year.

1. The "Hindsight" Problem: Why Indicators Often Lie

Most of us started by learning about "lagging indicators." These are tools that look at the past to tell you what to do now. Think of them like trying to drive a car by only looking at the rearview mirror.

Take a standard moving average, for example. It needs a chunk of past data just to give you one signal. By the time that signal finally tells you to "Buy," the big professional players have already finished their move and are looking to sell to latecomers. You’re essentially arriving at the party just as the host is turning off the lights. In a market that moves in split seconds, waiting for a slow signal to "confirm" a move is a recipe for getting stuck in a bad spot.

2. The High Cost of Being Human

The biggest hurdle in trading isn't your internet speed—it’s your own brain. Humans are wired for survival, not for the cold logic of the stock market. This leads to what many call "Human Lag," and it happens in three ways:

* The Hesitation: You see a great setup, but you wait "just one more minute" to be sure. By then, the price has already jumped, and you’ve missed the entry.

* The Hope: You see a trade losing money, but you hold it because you "feel" it will turn around. You turn a small loss into a disaster because you didn't want to admit you were wrong.

* The Fear: On the flip side, you might take a tiny profit way too early because you're scared it will vanish, even though the price is clearly still climbing.

While we are busy fighting our nerves, automated systems have already entered, hit their targets, and moved on. This "emotional tax" is often the only thing standing between a winning month and a losing one.

3. The "Retail Trap"

Big institutions know exactly how the average trader thinks. They know you’re likely putting your "stop-loss" (the price where you exit to prevent further loss) just below a common support line because that’s what every YouTube tutorial teaches.

Have you ever noticed the price dip just far enough to kick you out of your trade, only to immediately bounce back and go exactly where you thought it would? That’s called a liquidity grab. The pros use those piles of retail orders to fill their own massive trades. If your strategy is based on the same visual patterns that everyone else sees, you’re essentially trading with a target on your back.

4. Why Mathematics Must Replace "Intuition"

To survive in this high-tech era, you have to stop trading based on a "gut feeling" and start trading based on actual math and probability. It’s no longer about looking at one chart; it's about seeing the whole web:

* Watching the Whole Picture: Modern markets are connected. A shift in the currency market or a sudden spike in oil can change a stock's direction instantly. You need to watch the "vibe" of the whole market, not just one candle.

* Smart Risk: Most people risk the same amount on every trade. But a smart system changes the trade size based on how "noisy" or "crazy" the market is at that exact moment.

* 24/7 Monitoring: The market doesn't sleep. A news event on the other side of the world at 3:00 AM can change everything before you’ve even had your morning coffee. Humans can't stay awake forever, but machines can.

The Path Forward: Is Automation the Answer?

There was a time when having a computer was an "edge." Today, it’s the bare minimum. Competing manually against modern algorithms is like trying to win a race on a bicycle while everyone else is in a supercar. You might be the best cyclist in the world, but the physics simply aren't in your favor.

If you find yourself struggling with the "human" side of trading—the hesitation, the slow signals, or the constant need to stare at the screen until your eyes hurt—it might be worth looking into a more systematic approach.

That’s why we built Firefly here at Fintrens. To be totally honest, it’s not a "magic button" that makes you rich while you sleep, but it is a tool designed to take the emotional weight off your shoulders. It uses mathematical models to scan the market and execute moves with a level of precision that’s honestly just hard for a human to hit manually.

If you’re tired of being "a second too late" and want to try a more disciplined way of trading, you’re welcome to see how it handles today’s markets. We keep our performance verified on Sensibull, so you can see the real numbers for yourself. It’s about moving away from reacting to what happened yesterday and starting to act on what’s happening right now.

If you’re curious, you can see how Firefly by Fintrens works here,

Start here: https://www.fintrens.com

Deep-dive docs: https://docs.firefly.fintrens.com

Get real-time updates: https://whatsapp.com/channel/0029VackYjRLdQegrpD4uj2T

Join the community: https://www.fintrens.com/join

Disclaimer

This content is for education only and is not a recommendation to buy/sell any security or to use any strategy/system. Trading is high risk and you can lose all your capital. Automated systems can fail due to market conditions, connectivity, latency, slippage, broker/exchange restrictions, or unforeseen events. Any performance references are historical/verified where stated but are not a promise of future returns. Use risk controls and seek professional advice where needed.