🧨 Michael Burry’s $1.1 Billion Bet Against AI: Should Indian Investors Brace for the Next Big Short?

TL;DR → The man who predicted the 2008 crash is now shorting Nvidia and Palantir — the titans of the AI boom.

Is this another Big Short moment, and what should Indian investors do before the bubble bursts?

✍️ By Ibin Issac, CTO & Co-founder, Fintrens | Algo Trading Expert

🌐 www.fintrens.com

Michael Burry’s AI Bubble Bet Explained

Michael Burry — the hedge-fund genius who foresaw the 2008 US housing crash and inspired The Big Short — has placed a $1.1 billion short against AI-heavy stocks Nvidia and Palantir.

Through put options, he’s effectively betting those prices will fall.

On X (formerly Twitter) he wrote:

“Sometimes, we see bubbles. Sometimes, the only winning move is not to play.”

That single post jolted markets worldwide.

Global Markets React: From Wall Street to Tokyo

- Japan’s Nikkei 225 ↓ 2.5 % (SoftBank −10 %)

- South Korea’s Kospi ↓ 2.85 % (Samsung −4 %, TSMC −3 %)

- US Tech: Nvidia −4 %, Amazon −1.8 %, Palantir −3 %

Investors are asking: Have AI valuations outrun earnings reality?

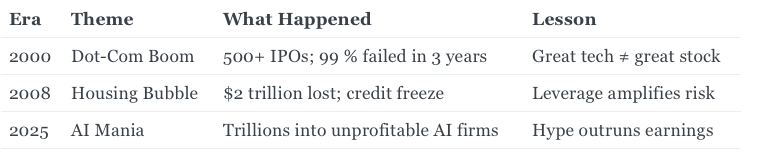

Why AI Bubbles Happen — Lessons From History

Every bubble begins with innovation and ends with irrational optimism.

“AI enthusiasm has definitely stretched valuations,” says Farhan Badami (eToro).

“Some companies spend more on hype than they earn in profits.”

How Indian Investors Are Exposed to the AI Bubble

AI isn’t just a Wall Street story anymore — it’s deep inside Indian portfolios:

- Mutual Funds: ETFs tracking Nasdaq 100 hold Nvidia, AMD, Palantir.

- Direct Stocks: Indian investors using global brokers own AI leaders outright.

What Indian Regulators Are Saying

The SEBI and NSE have tightened rules for automated strategies.

👉 Read our recent blog onSEBI-compliant algo trading to stay aligned.

Why Burry Might Be Wrong This Time

Not everyone agrees with Burry.

Enterprise AI adoption is real; cloud revenues are scaling; chip demand remains strong.

Even if valuations correct, AI fundamentals may support long-term growth.

The key is valuation-aware participation, not panic exits.

Case Study: An Indian Retail Trader’s Dilemma

“I’m up 42 % in Nvidia YTD,” says Rajesh from Mumbai.

“After Burry’s short, should I hold or exit?”

Rajesh’s story mirrors thousands of retail traders.

Use FireflyByFintres to simulate scenarios before acting emotionally.

Action Items for This Week

✅ Audit AI exposure (> 30 % = high risk)

✅ Backtest through crisis windows (2008, 2020)

✅ Add defensive assets like gold ETFs

✅ Join our WhatsApp Channel for updates

FAQs — AI Bubble Questions Indians Are Asking

Who is Michael Burry?

The hedge-fund manager who predicted the 2008 crash and inspired The Big Short.

What’s his current bet?

A $1.1 billion short against Nvidia and Palantir via put options.

Should I sell my AI stocks now?

Not blindly. Reassess valuations and automate exits with Firefly.

Is Nvidia overvalued?

At multi-trillion levels maybe — but AI chip demand is still strong.

When will the AI bubble burst?

When earnings can’t match expectations — watch Q1 2026 results.

Join the Discussion

🗳️ Poll: Do you think Michael Burry is right this time?

Vote and comment on LinkedIn or X using #AIBubble2025 #BigShort2 #Fintrens

About the Author

Ibin Issac — CTO & Co-founder, Fintrens.

Tech enthusiast with 5 years building algo trading systems for Indian markets.

Stay Connected

📘 Firefly Docs – Automated trading APIs

🌐 Join Fintrens – India’s fastest-growing no-code algo trading community

💬 WhatsApp Channel – Follow us