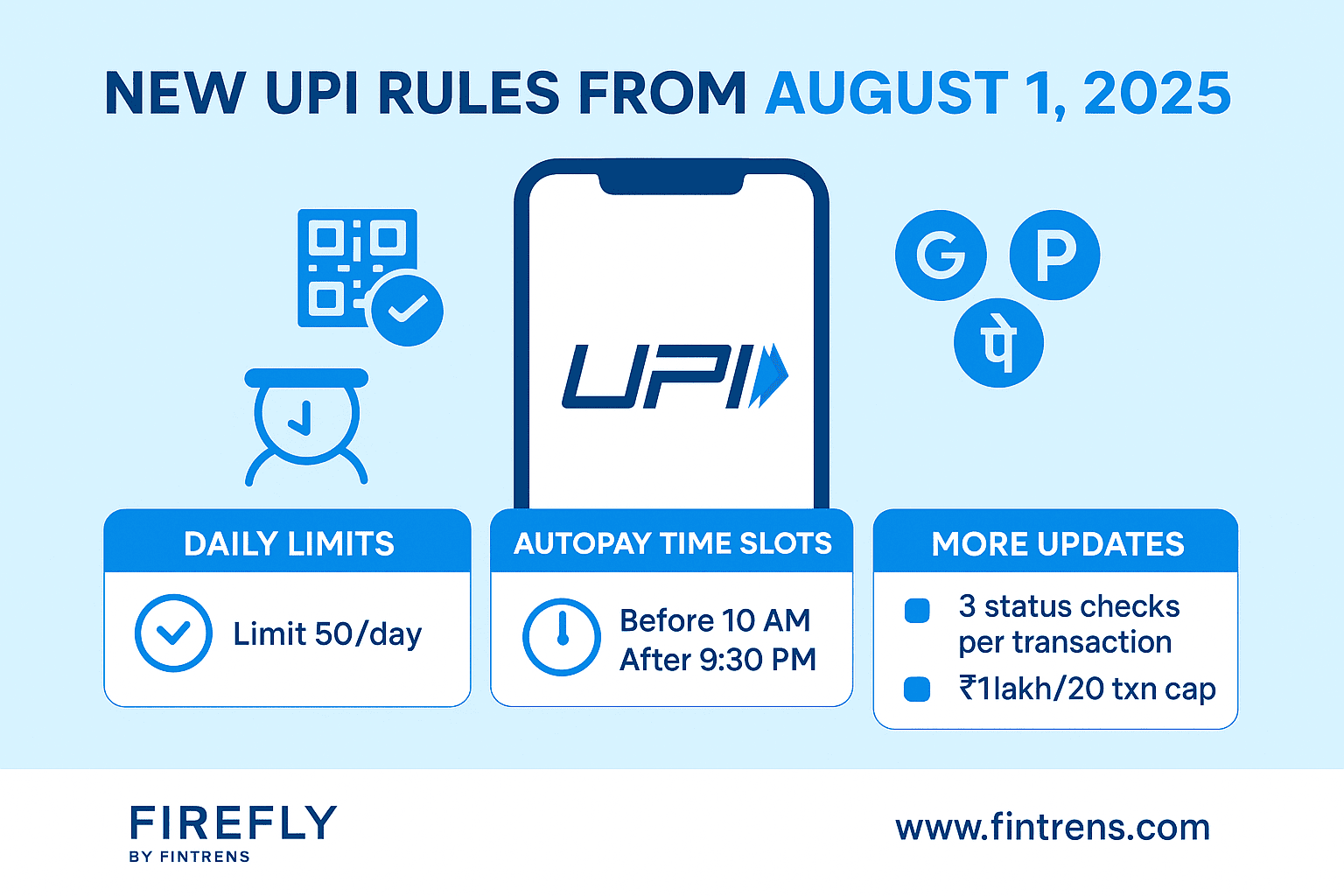

New UPI Rules from August 2025: What Every Indian User Must Know

Starting 1st August 2025, the National Payments Corporation of India (NPCI) has rolled out key updates to the Unified Payments Interface (UPI) framework. These changes are aimed at ensuring smoother performance, reducing server overload, and making India’s favourite digital payment system more robust and secure as UPI continues to grow exponentially.

With UPI clocking over 18.4 billion transactions worth ₹24.04 lakh crore in June 2025 alone, platforms like Google Pay, PhonePe, and Paytm are directly impacted.

Here's a simplified breakdown of everything you need to know about the updated UPI rules.

1. Balance Check Limit: 50 Times Per App, Per Day

You can now check your bank account balance via UPI apps only 50 times a day per app. This applies to manual user-initiated balance checks.

Apps can no longer perform automatic background balance checks. Instead, banks will now show your updated balance automatically after each financial transaction to reduce unnecessary API calls that congest the system.

Also, apps must reduce or pause balance requests during peak hours (10:00 AM – 1:00 PM and 5:00 PM – 9:30 PM).

2. Autopay Transactions Restricted to Non-Peak Hours

All automatic recurring payments like EMIs, utility bills, and subscriptions will now be processed only during off-peak time slots, which are:

- Before 10:00 AM

- Between 1:00 PM and 5:00 PM

- After 9:30 PM

Each autopay attempt gets one try and up to 3 retries. If your autopay was earlier set for peak time, it will now be rescheduled automatically to the next available non-peak window.

3. UPI IDs Inactive for 12 Months Will Be Deactivated

If you haven't used your UPI ID (linked to a mobile number) for over 12 months, it will be automatically deactivated. This prevents fraud and misuse due to number reassignment by telecom providers.

You can still make outgoing payments using your UPI PIN, but you'll need to re-register to receive payments again.

4. No New Charges for Personal Transactions

Contrary to viral rumours, NPCI has not introduced any charges for personal UPI transactions, regardless of the amount.

However, merchant transactions via prepaid wallets (PPIs) above ₹2,000 still attract an interchange fee of 1.1%, as per existing rules. This fee is paid by the merchant, not the customer.

If you exceed the 50 daily balance check limit, you’ll just get an error — no fee is charged.

5. Defined Off-Peak Windows for Autopay

UPI's busiest times are:

- 10:00 AM to 1:00 PM

- 5:00 PM to 9:30 PM

To maintain stability, NPCI mandates all autopay transactions to be moved outside these time slots. While this could delay some payments, it will reduce failures and enhance reliability.

6. Business Accounts May Get Relaxations

The 50-check daily cap and API usage limits mainly apply to individual users. Businesses or fintechs handling large transaction volumes can apply to NPCI for higher thresholds.

They must show valid use cases and strong fraud controls. Rate limits still apply during peak hours to protect system stability for all users.

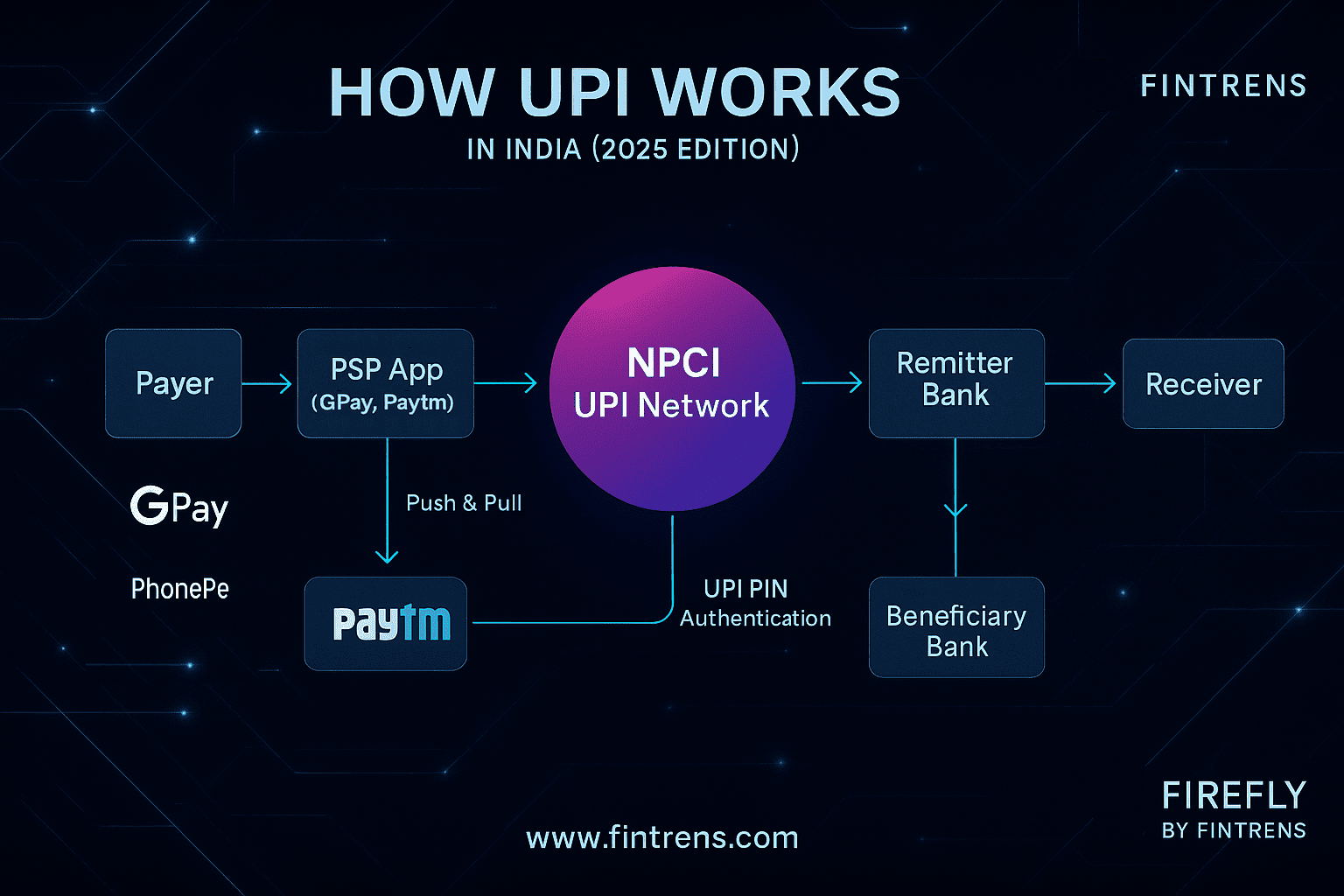

7. How UPI Works: A Quick Overview

UPI connects users, merchants, and banks through a four-party model, operating via NPCI’s central infrastructure. It enables real-time transfers between your remitter bank and the recipient’s bank using:

- PUSH (user-initiated payments)

- PULL (payment requests)

Each transaction requires device fingerprinting and 6-digit UPI PIN authentication. UPI currently handles over 7,000 transactions per second, with 500+ million active users.

8. Why These Changes Were Necessary

India’s UPI system is under immense load, processing over 613 million daily transactions. Peak-time delays, mandate failures, and infrastructure strain prompted these proactive steps.

The updates help NPCI achieve 3 critical goals:

- Reduce unnecessary automated calls

- Improve success rates by load balancing

- Ensure system scalability, especially in rural & global markets

Think of it like a digital toll system: regulating traffic to ensure fast and secure passage for everyone.

Final Thoughts: UPI is Smarter, Safer & Scalable

These new UPI rules from August 2025 are not just about restrictions — they are about building a more reliable and secure digital payment future for India. Whether you're a retail user or a fintech innovator, these changes are designed to keep UPI responsive and available for all.

For investors, traders, and tech-savvy individuals looking to ride the future of smart automation, Firefly by Fintrens brings intelligent, fully SEBI-aware algo trading bots for the Indian stock market.

- Explore Firefly: www.fintrens.com

- Learn more in docs: docs.firefly.fintrens.com

- Join our WhatsApp channel: Click to Join

- Want to trade smarter? www.fintrens.com/join

Stay ahead, trade smart, and adapt to India's rapidly evolving fintech landscape with Fintrens.