🧠 NSE Retail Algo Trading Rules Nov 2025: Static IP, Order Tagging & Compliance Guide

🚀 NSE Just Dropped New Algo Trading Rules — Here’s What Changes for 50,000+ Retail Traders

On 3 November 2025, the National Stock Exchange (NSE) issued an official FAQ on “Safer Participation of Retail Investors in Algorithmic Trading”, clarifying how algo trading can be made safer and more compliant for Indian retail participants.

If you use platforms like Firefly by Fintrens or connect directly to broker APIs, these clarifications affect how you trade, host, and tag your algorithmic orders starting this quarter.

⚖️ Why It Matters

India’s retail algo trading ecosystem is rapidly growing — with over 50,000+ active algo users in 2025.

This FAQ ensures transparency, control, and accountability across brokers, algo vendors, and tech-savvy traders.

🔑 Key Takeaways from the NSE Retail Algo FAQ (03 Nov 2025)

1️⃣ Empanelment Criteria for Algo Providers

- Only empanelled Algo Providers can offer retail algo services.

- Providers must submit a self-declaration of any cyber or adverse technical incidents in the past three years.

- No auditor signature required — a company letterhead declaration is sufficient.

Ref: NSE/INVG/70309 (Sep 19, 2025)

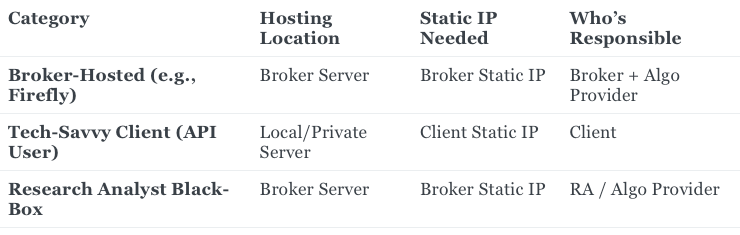

2️⃣ Static IP Requirements

- Static IP is mandatory only for Tech-Savvy Clients using direct APIs for trading.

- Retail clients using broker-hosted platforms (like Firefly’s integrated environment) don’t need static IPs.

- When the algo runs on a broker’s server, the Trading Member’s static IP is used for compliance.

Ref: NSE/INVG/67858 (May 5, 2025)

💡 Tip: Learn how to request a whitelisted static IP from your broker — this step is crucial for direct API access.

3️⃣ Research Analysts & Black-Box Algos

- A Research Analyst (RA) offering a black-box strategy must first register as an Algo Provider.

- One provider cannot host multiple third-party RA algos.

- Every black-box algo must be hosted on the broker’s infrastructure for monitoring.

Ref: SEBI/HO/MIRSD/MIRSD-PoD/P/CIR/2025/0000013 (Feb 4, 2025)

4️⃣ Hosting Rules & Risk Management

- All algo strategies must execute from the broker’s servers.

- Order messages must originate from these servers for real-time RMS control.

- However, tech-savvy clients can host their algo locally — using a static IP and taking full risk responsibility.

5️⃣ Order Tagging & Restrictions

- Algo orders via Internet or Mobile APIs must be tagged:

- First 12 digits:

444444444444 - 13th digit:

0,2, or4

- First 12 digits:

- Market and IOC orders are not allowed — across both Equity and Commodity segments.

Ref: NSE/MSD/67753 (Apr 29, 2025)

6️⃣ Basket Orders & OPS Limits

- All orders received via API are considered algo orders.

- Even if Order-Per-Second (OPS) rate is below 10 OPS, tagging and compliance apply.

7️⃣ Mock Trading Exemption

- Tech-Savvy Clients running self-hosted algos are exempt from monthly mock sessions.

- All other entities — brokers, vendors, and platform providers — must participate.

Ref: SEBI/HO/MRD1/DSAP/CIR/P/2020/234 (Nov 24, 2020)

📊 Comparison: Retail Algo Hosting Models

🧮 Frequently Asked Questions

Q1. Do I need a static IP for algo trading in India?

→ Only if you are a tech-savvy trader using APIs directly. Broker-hosted algo platforms handle this internally.

Q2. What is algo order tagging?

→ NSE requires specific numeric tags (e.g., 4444444444440/2/4) for all retail API orders for traceability.

Q3. Are Market and IOC orders allowed in algo trading?

→ No. NSE bans Market and IOC order types across all segments for algo execution.

Q4. How do I register as an NSE Algo Provider?

→ Submit empanelment documents and self-declaration as per NSE/INVG/70309 via your trading member.

💬 Case Study: How Compliance Could Prevent Costly Errors

In July 2024, an independent trader lost ₹10 lakh when his untagged algo fired multiple market orders during high volatility.

Under the 2025 framework, such incidents are preventable because:

- Market orders are now blocked.

- Each algo is identifiable through tagging.

- Risk management runs on broker servers.

This is exactly why NSE’s rules matter.

⚖️ Balanced View — Why Some Traders Say the Rules Favour Institutions

While most experts welcome stricter risk control, some independent developers argue these rules make it harder for small retail coders to innovate.

However, NSE’s intent is clear: to protect retail investors without banning automation — and ensure equal infrastructure access through empanelled providers.

💡 Fintrens Viewpoint

At Fintrens, we believe these changes build long-term trust in India’s algo ecosystem.

We’re continuously updating our Firefly framework to keep every user NSE-ready and SEBI-compliant.

📎 Downloadable Resource

📄 Download: NSE Algo Compliance Checklist 2025 (PDF)

📘 Useful Links

- 🔗 Fintrens Official: www.fintrens.com

- 📖 Firefly Documentation: docs.firefly.fintrens.com

- 💬 Join WhatsApp Channel: https://whatsapp.com/channel/0029VackYjRLdQegrpD4uj2T

- 🤝 Join: www.fintrens.com/join

⚠️ Disclaimer

This post summarises NSE’s “FAQ on Safer Participation of Retail Investors in Algorithmic Trading” published on 3 November 2025.

For exact compliance references, please review NSE/INVG/70309, NSE/INVG/69255, NSE/MSD/67753, and SEBI/HO/MIRSD/MIRSD-PoD/P/CIR/2025/0000013 available at nseindia.com.

This article is for educational purposes only — not financial advice.