🚨 SEBI Blinked: The Algo Cliff That Could Lock Out 500,000 Traders by January 5

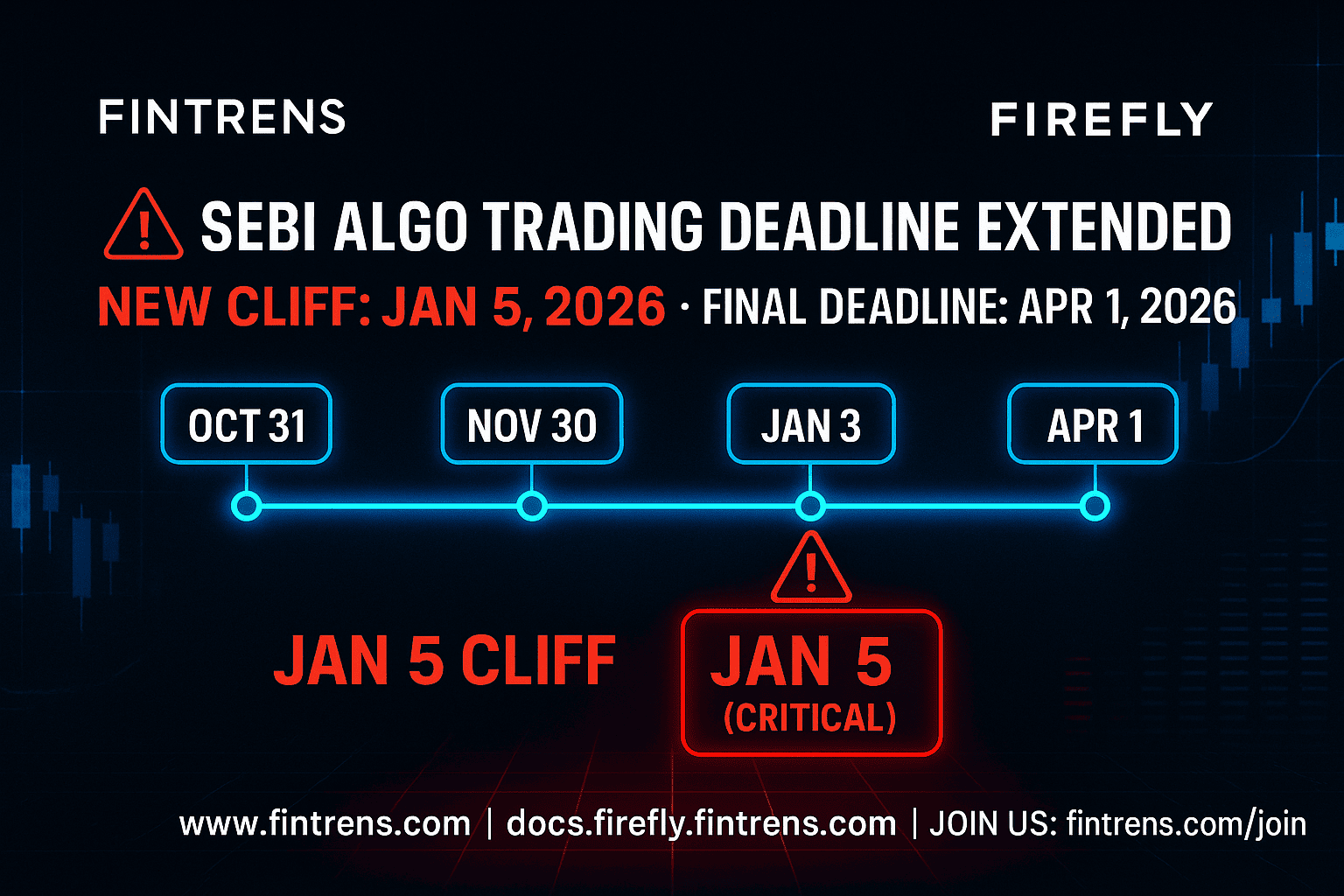

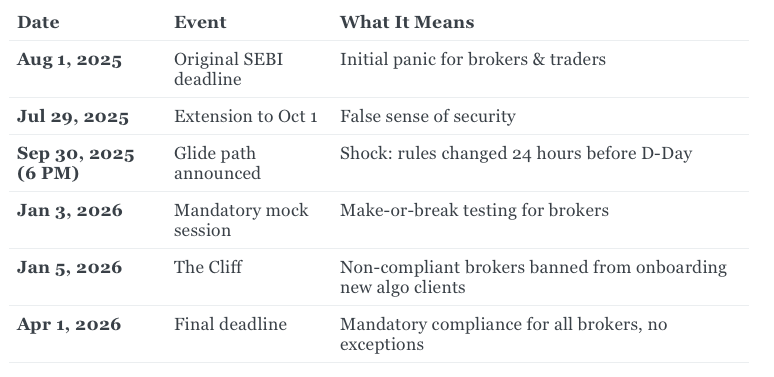

September 30, 2025: Just 24 hours before the October 1st compliance deadline, SEBI dropped a last-minute circular that didn’t just extend the timeline—it rewrote the rules for India’s ₹2,312 crore algorithmic trading market.

Circular SEBI/HO/MIRSD/MIRSD-PoD/P/CIR/2025/132, signed by General Manager Aradhana Verma today, introduced a “glide path” with phased milestones. While this feels like relief, it hides a brutal reality: if your broker misses the January 3rd mock testing, they’ll be banned from onboarding new algo clients starting January 5, 2026.

This isn’t a reprieve—it’s a 183-day survival race.

⏳ The Timeline of Chaos: From Hard Deadline to Hidden Cliff

⚠️ Visualise this: 95 days left to the Jan 3rd mock, 183 days to final April 1 deadline.

📊 The Glide Path: What Brokers Must Do

- Milestone 1 – October 31, 2025

- At least one retail algo strategy registered with exchanges.

- API-based products submitted.

- Milestone 2 – November 30, 2025

- Multiple algo products registered.

- Full API integration live.

- Milestone 3 – January 3, 2026 (Critical)

- Brokers must join at least one mock trading session.

- Proof must be submitted.

- ❌ Miss this, and your broker can’t take new algo clients from Jan 5.

- Final Deadline – April 1, 2026

- Complete framework becomes mandatory for every broker.

🔍 The Hidden Deadline Nobody Talks About

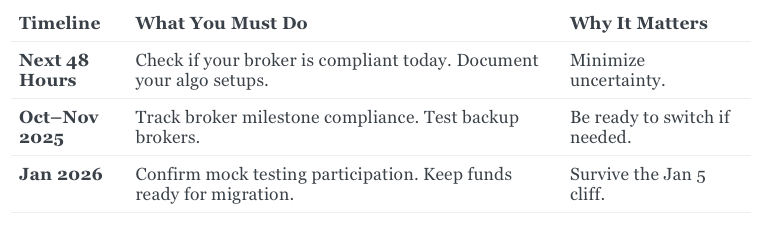

Brokers not ready by October 1st must submit their existing client numbers to exchanges tomorrow.

👉 If your broker doesn’t file this, they’re officially admitting non-compliance. That puts your trading setup at risk.

👤 What This Means for Retail Algo Traders

- If your broker is ready: You can continue without disruption.

- If not: You may need to migrate to a compliant platform before January.

- Your strategies: Might require re-registration and testing under SEBI rules.

- The market: With 57% of equity and 70% of derivatives already algo-driven, disruption risk is huge.

🚨 Your 48-Hour Survival Checklist

🧪 Real-World Trader Example

- If you’re running a BankNIFTY straddle via API, your broker must show proof that their systems passed mock testing by Jan 3.

- If they fail → On Jan 5, you can’t onboard new algo trades with them. You may be forced to shift to a compliant broker—risking downtime, slippage, and strategy rewrites.

🚩 Why This “Extension” Might Hurt More

- Market Fragmentation: Compliant brokers gain a competitive edge.

- Uncertainty: Traders don’t know which brokers will survive till April.

- False Confidence: Many assume the extension means safety—it doesn’t.

🚀 Why Firefly by Fintrens Is Already Ahead

At Firefly, we anticipated SEBI’s framework:

- ✅ API-ready architecture with SEBI-aligned risk controls.

- ✅ SEBI-compliant strategy registration process.

That means:

- No disruption to your trades.

- Seamless migration of strategies.

- Confidence your platform is built for 2026 and beyond.

👉 Start here: www.fintrens.com

📖 Learn more: docs.firefly.fintrens.com

📱 WhatsApp Alerts: Join here

🚀 Get Firefly: www.fintrens.com/join

❓ FAQs on SEBI’s Algo Trading Rules

Q. What is SEBI’s new deadline for algo trading compliance?

👉 April 1, 2026 is the final, mandatory deadline.

Q. What happens if my broker misses the Jan 3 mock session?

👉 They are banned from onboarding new algo clients starting January 5, 2026.

Q. Can I keep trading if my broker is non-compliant?

👉 You may still run existing trades, but new API-based algo clients can’t be added. Migration may be required.

Q. Which brokers are ready?

👉 SEBI requires brokers to report client readiness by October 1. Ask your broker for proof.

📢 Final Word: The Next 183 Days Decide Everything

SEBI’s circular isn’t a free pass—it’s a countdown clock.

- Traders: Double-check your broker NOW.

- Brokers: Hit milestones or get locked out.

- Platforms like Firefly: Already future-ready.

🚨 Tag 3 traders who need this warning. Share this in your WhatsApp groups. Don’t let anyone get blindsided on January 5.