SEBI Digital Gold Warning 2025: Is Your Investment Safe?

⚠️ The Shocking Truth: Many “Digital Gold” Buyers Have Zero SEBI Protection

In November 2025, the Securities and Exchange Board of India (SEBI) issued a public warning that shook retail investors — most “Digital Gold” schemes are not regulated and could expose you to major risks.

But what does this really mean? If you’ve already invested through an app promising “24K digital gold”, are you in danger?

Let’s break it down — clearly, practically, and with actionable steps to protect your money.

🧾 What SEBI Actually Said

According to SEBI Press Release No. 70/2025 (dated 8 Nov 2025):

Digital/online platforms are offering investors to invest in “Digital Gold/E-Gold Products” which are neither notified as securities nor regulated as commodity derivatives.

This means:

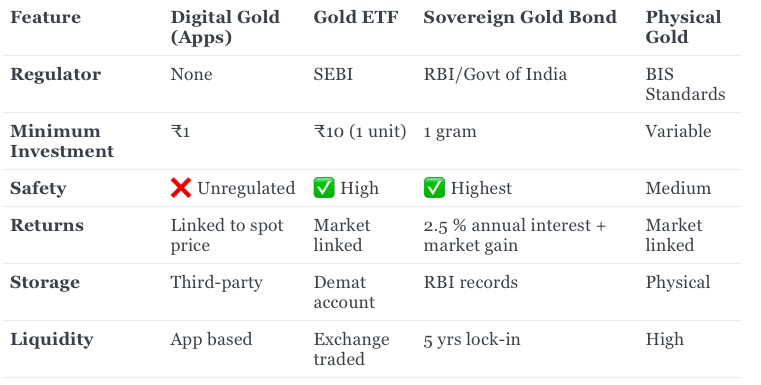

✅ Regulated Gold Products (Safe)

- Gold ETFs – Offered by mutual funds registered with SEBI

- Electronic Gold Receipts (EGRs) – Tradeable on NSE/BSE

- Gold Futures & Options – On recognised exchanges

❌ Unregulated “Digital Gold” (Risky)

- Sold by private apps or jewellers

- No SEBI oversight

- No investor protection or refund guarantee

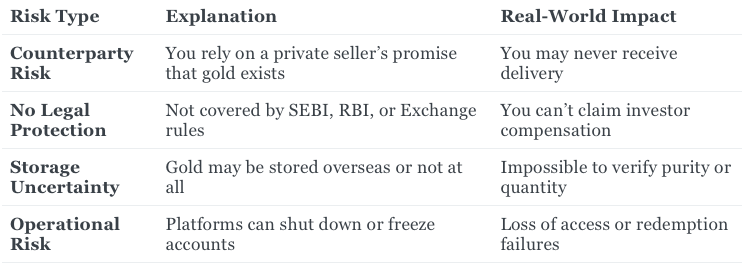

💣 Why “Digital Gold” Is Dangerous

💬 Example: Rahul from Pune invested ₹3 lakh in “digital gold” through an app that shut down in 2024. With no SEBI registration or grievance mechanism, his case went nowhere.

🧠 What To Do If You Already Own Digital Gold

- Check Your Platform’s Credentials

- Visit SEBI Registered Intermediaries

- Search the company name — if it’s missing, it’s not SEBI-regulated.

- Redeem or Sell Immediately

- If redemption is available, move to physical delivery or sell and transfer proceeds to your bank.

- Report Unauthorised Platforms

File a complaint via SEBI SCORES Portal

- Shift to Regulated Alternatives

- Gold ETFs or Sovereign Gold Bonds (SGBs) offer liquidity + safety.

📊 Comparison: Digital Gold vs Regulated Gold Options

🔍 How To Verify a SEBI-Registered Platform (Step-By-Step)

- Go to SEBI Intermediaries Portal

- Click “List of Registered Intermediaries”

- Choose category: Stock Broker / Mutual Fund / Exchange

- Type the platform or broker name

- Confirm registration number begins with INB / INZ / ARN

✅ Pro Tip: If your platform doesn’t show up — exit immediately.

💡 Fintrens Insight: Smart Investors Follow the Rulebook

At Fintrens, our mission is clear — help every Indian investor make regulated, data-driven, compliant decisions.

🔥 Firefly users don’t worry about counterparty risk — they trade only through regulated intermediaries.

🧮 Interactive Checklist: Is Your Gold Investment Safe?

☐ Platform listed on SEBI/RBI site

☐ Investor protection clearly stated

☐ Option for delivery or demat

☐ Transparent fees and storage location

☐ Regulated intermediary code visible

✅ If you tick all 5 — you’re safe.

❌ If even 1 is missing — redeem immediately.

🤝 Protect Your Wealth — The Fintrens Way

Before you buy gold online:

- Verify the regulator.

- Understand the product.

- Choose transparency > trend.

Fintrens helps you automate, verify, and invest confidently — the compliant way.

🔗 Stay Connected

🌐 www.fintrens.com 📘 docs.firefly.fintrens.com

💬 Join our WhatsApp Community → Fintrens Channel

🚀 Be Part of the Future → www.fintrens.com/join