She Quit Her ₹24 Lakh/Year IT Job at 35 — The Controversial Strategy That Split Opinions in India’s Finance Circles

“My family thought I’d lost my mind when I said I wanted to retire at 35.

But for the first time, I was actually living — not just earning.”

Phase 1: From Salary Spender to Smart Investor

Before 2020, Janvi lived the typical Bengaluru tech life — 9-hour shifts, 5-day sprints, and 0 time for herself.

When the pandemic hit, she realised her savings barely covered six months of expenses.

So she flipped the equation — saving and investing 50 % of her ₹2 lakh monthly salary in equity mutual funds.

That’s ₹1 lakh a month → ₹36 lakh over 3 years in principal.

“Between 2020 and 2023, her equity mutual funds rode India’s post-pandemic bull run, compounding at ~12–15 % annually.”

By mid-2023, her disciplined SIPs had grown into a ₹50 lakh corpus — the foundation of what came next.

Phase 2: Discovering Firefly — Turning Investments into Income

In 2023, Janvi discovered Firefly by Fintrens — an SEBI-aware algo trading bot that trades directly in the investor’s own brokerage account.

She didn’t jump blindly.

Two months of research later, she understood algo trading, margin mechanics, and risk management.

How she started:

She pledged ₹10 lakh of her mutual fund holdings to get trading margin.

Since her broker offered interest-free trade margin (no borrowing cost), her full capital stayed productive.

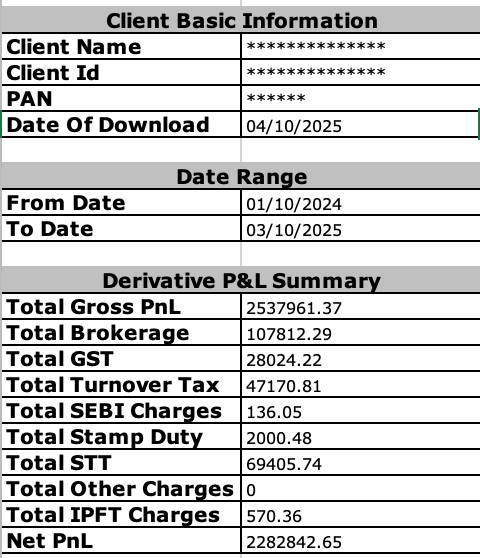

Over the following 12 months, Firefly generated an average annualised profit of around 40 % — realistic, consistent, and fully auditable through her broker statements.

“The first month was down, and I panicked. But when I saw Firefly recover within the next cycle, I understood how discipline beats emotion.”

Phase 3: The Reality Check

Early retirement looks glamorous — but it demands planning.

| Risk | Janvi’s Mitigation |

|---|---|

| Market downturns | 12-month cash buffer in FDs |

| Margin calls | Limited leverage; capped exposure |

| Healthcare inflation (7 – 10 %) | SIP into health corpus |

| Income fluctuation | Uses only 50 % of Firefly income for expenses |

| Psychological stress | Reviews quarterly, not daily |

Firefly didn’t remove risk — it made it measurable.

Phase 4: Building a Realistic Safety Net

While Firefly powers her monthly income, Janvi also keeps emergency reserves in fixed deposits and a company EPF corpus of ₹18 lakh.

Her familys’ house in Bengaluru gives her housing stability — a massive advantage for any early retiree.

“My mother still sends me job listings every week. My friends think I’ll return in a year. I’m proving them wrong — with data, not emotion.”

For context: the average Indian IT professional retires at 58 – 60, after 20 + years of savings.

Janvi compressed that timeline by combining aggressive saving with intelligent automation.

💬 The Debate: Is This Replicable or Reckless?

Supporters say disciplined automation is democratising wealth creation.

Critics warn margin-based strategies can lead to liquidation in crashes.

Janvi’s view:

“I sized my bets to sleep peacefully. That’s personal finance.”

🔒 How Firefly Aligns with SEBI 2025 Regulations

Firefly by Fintrens operates with:

- ✅ OPS (Orders Per Second) Limit Compliance

- ✅ Direct client-account execution — no pooled trading

- ✅ Static IP + two-factor authentication

[Below: Sample P&L screenshot showing 12-month performance]

Phase 5: Freedom — Not a Fairy Tale

At 35, Janvi took the leap.

She now splits her income: 50 % reinvested via Firefly, 50 % enjoyed on travel and family time.

“Freedom isn’t about never working again. It’s about having the choice to.”

📋 Want to Explore This Path?

Here’s how to start responsibly 👇

1️⃣ Build your base — keep 6–12 months of expenses in cash/F.D.

2️⃣ Study before you trade — review Firefly’s backtests & risk metrics → docs.firefly.fintrens.com

3️⃣ Test small — begin with 10–15 % of your investible corpus

4️⃣ Track honestly — maintain a trading journal for 6 months

5️⃣ Join the community — learn from others → WhatsApp Channel

🌐 Explore Firefly: www.fintrens.com

💬 Join: www.fintrens.com/join

Firefly currently serves 1,000 + retail investors across India, with verified monthly trading volumes exceeding ₹ 100 crore.