The Signal vs. The Noise: What 1,000 Hours of Market Data Taught Us

Most people look at a stock chart and see a story. They see a "head and shoulders" pattern, a "breakout," or a "dip" that looks like a bargain.

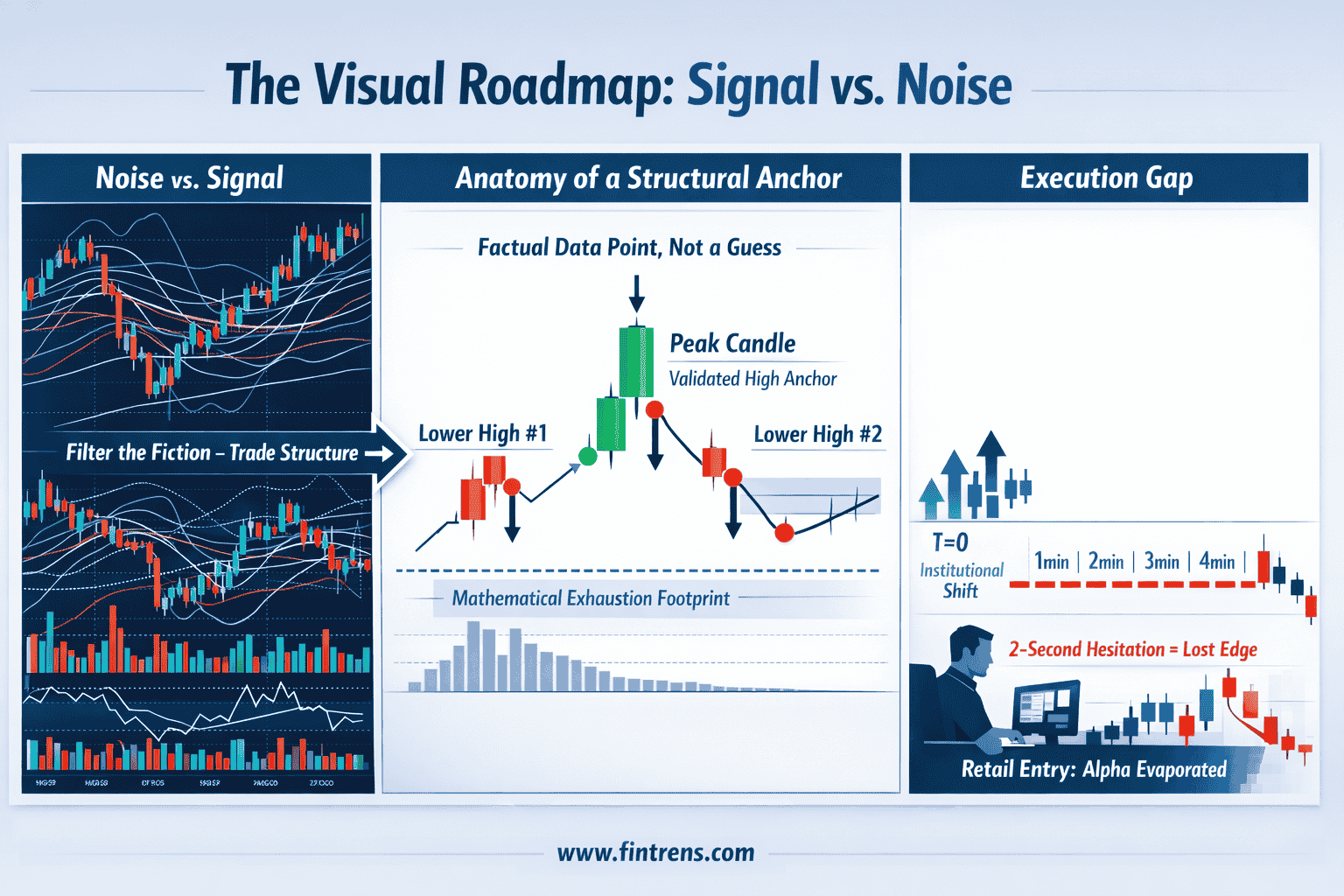

After a decade of staring at the same screens and crunching raw numbers, I’ve realized that most of those stories are fiction. The market doesn’t move because of pretty shapes on a graph; it moves because of massive shifts in supply and demand—the "big money" moving—that happen long before a human eye can spot them. To win consistently, you have to stop looking at the "ghosts" in the charts and start reading the actual Market Structure.

Why 90% of what you see is a distraction

If you’ve ever entered a trade that looked "perfect" only for it to immediately reverse the second you clicked 'buy,' you’ve experienced The Noise. Noise is the chaos of the market—retail panic, social media hype, and random price flickers. If you trade the noise, you aren't investing; you’re gambling on randomness. To find a true Signal, you have to look past the colorful candles and focus on the three invisible forces moving the needle:

- Liquidity: These are the "pockets" where massive institutional orders are sitting. They act like magnets for the price.

- Order Flow: This tells us who is actually being aggressive. Is the price moving because people are desperate to buy, or simply because there are no sellers left?

- Market Regime: Is the market "balanced" (bouncing in a range) or "imbalanced" (sprinting in a clear direction)?

The Language of the Tape: Structural Anchors

To stay objective, we don't guess where the market is going. Instead, we look for Structural Anchors. These aren't just random "highs" or "lows" you see on a screen.

An anchor is a mathematical "footprint" left behind when a massive institution finishes its move. Think of it like a heavy ship turning in the ocean; it cannot stop or turn instantly. It leaves a wake. In a healthy trend, the market creates a stair-step pattern of higher peaks and higher "floors."

We call these floors Structural Anchors. When the price breaks one of these floors, it isn’t just a "bad day" for the stock—it is a factual, data-driven shift in the market’s backbone. The story has changed, and the data is proving it. By focusing on these anchors, we remove the need for 50 different indicators. We only care about one thing: Is the structure holding or breaking?

The Filtering Process: Using a Checklist instead of a Guess

Most traders fail because they have too much information. They follow news, social media, and five different indicators. When you have that many voices in your ear, you can always find a reason to justify a bad trade.

To fix this, we use a simple "green light" system called The Alignment. Think of it as a quality filter. We only move when three specific things happen at the same time:

- The Level: Is the price sitting on a strong "floor" (a Structural Anchor)?

- The Power: Are the big institutional buyers actually stepping in right now?

- The Path: Is there enough room for the price to move without hitting a wall of sellers?

If even one of these lights is red, we don't trade. It doesn't matter how "good" the chart looks or what our "gut" tells us. By using this strict checklist, we stop trying to predict what might happen and start reacting to what is actually happening. We aren't guessing; we are just waiting for the data to line up.

The Problem with the Human Brain

The human brain is an incredible machine for spotting patterns. This helped our ancestors survive in the wild by spotting tigers in the grass, but it’s a massive liability in modern trading. We are wired to see patterns even when they don’t exist.

By the time a human trader sees a "strong trend" on a 5-minute chart, the actual move—the institutional entry—usually happened four minutes ago. Most retail traders aren't just late; they are arriving exactly when the big players are getting ready to exit. To win with data, you have to kill your "gut feeling." You must accept that your intuition is often just a bias—or a memory of a past trade—disguised as wisdom.

The War of Execution

Understanding the market is only 20% of the battle. The other 80% is execution. Even with perfect data, humans hesitate. We wait for "one more candle" to feel safe. We let fear or greed change our exit point at the last second.

In the world of high-speed trading, a two-second hesitation is the difference between a profit and a loss. The "Alpha" (the profit edge) evaporates in the time it takes you to blink. You aren't just fighting other traders; you are fighting your own biological clock and the stress that comes with every tick of the price.

Why we built Firefly

This frustration—the gap between seeing the data and acting on it—is exactly what led us to build Firefly. We didn’t build it to be a "magic bot." We built it because we were tired of being limited by human biology.

We needed a filter that could process liquidity shifts and structural breaks in milliseconds—tasks that are physically impossible for a person. Firefly doesn't have a "hunch." It doesn't get nervous after a losing streak. It simply executes the logic we spent thousands of hours proving. It’s a tool designed to stop chasing the ghosts—and start reacting to the reality of the data.

Closing the Gap

Success in the markets isn't about being "smarter" than everyone else. It's about being more disciplined and having a better filter for information. The market is a flood of data. If you try to drink from the firehose, you’ll drown. But if you focus on Structural Anchors and ignore the Noise, the path becomes clear. It’s time to stop trading stories and start trading structure.

Explore Firefly / Start here: https://www.fintrens.com

Deep-dive docs: https://docs.firefly.fintrens.com

Get real-time updates: https://whatsapp.com/channel/0029VackYjRLdQegrpD4uj2T

Join the community: https://www.fintrens.com/join

Disclaimer

This post is for educational and informational purposes only and does not constitute financial advice, investment advice, or a recommendation to buy or sell any security. Markets involve risk, and past performance does not guarantee future results. Always do your own research and consult a qualified financial advisor before making trading or investment decisions.