This 35-Year Retirement Experiment Will Shock You: Why Smart Indians Are 7X Richer

⚠️ Important Disclaimer

This is a hypothetical, illustrative case study. The numbers (including Firefly’s 35% CAGR sleeve) are not audited performance and not guarantees of future results. Markets involve risk of loss. Inflation, taxation, market volatility, and personal risk tolerance must be carefully considered. Fintrens/Firefly is a technology platform, not an investment adviser; all execution is via SEBI-registered brokers.

Three couples.

Same starting salary.

Same EMIs.

Same kids at the same ages.

Same ₹2 crore house purchase at 33.

Yet, after 35 years, their retirements look nothing alike:

- Amit & Neha (Spenders): Just ₹26.4 lakh (inflation-adjusted)

- Ravi & Priya (Traditionalists): About ₹2.8 crore

- Karan & Meera (Smart Diversifiers): Over ₹141 crore

What separates them isn’t luck, inheritance, or windfalls.

It’s the financial discipline and asset allocation choices they made — and how those choices compounded over decades.

The Setup (Common to All Three Couples)

- Starting age: 25, retiring at 60

- Income path (per person): ₹20,000/month at 25 → ₹1,00,000 by 30 → ₹2,00,000 by 35 (flat thereafter)

- Household income at 35+: ₹4,00,000/month

- Kids: First at 28, second at 31

- Inflation: 6% annually (~7.7× erosion factor over 35 years)

- Tax slabs (simplified): 10% till 30, 20% till 35, 30% after 35

- Home: Buy ₹2 Cr house at 33 (EMI ≈ ₹1.5L/m for 20 years)

- Cars:

- Car #1 at 27: ₹7L (EMI ≈ ₹14k/m for 5 years)

- Car #2 at 35: ₹30L (EMI ≈ ₹55k/m for 7 years)

- Vacation home: Ravi–Priya & Karan–Meera buy a ₹40L property at 40 (EMI ≈ ₹40k/m for 15 years)

- At 60: All shift growth assets → safer debt + FDs for capital protection & retirement income

Meet the Couples

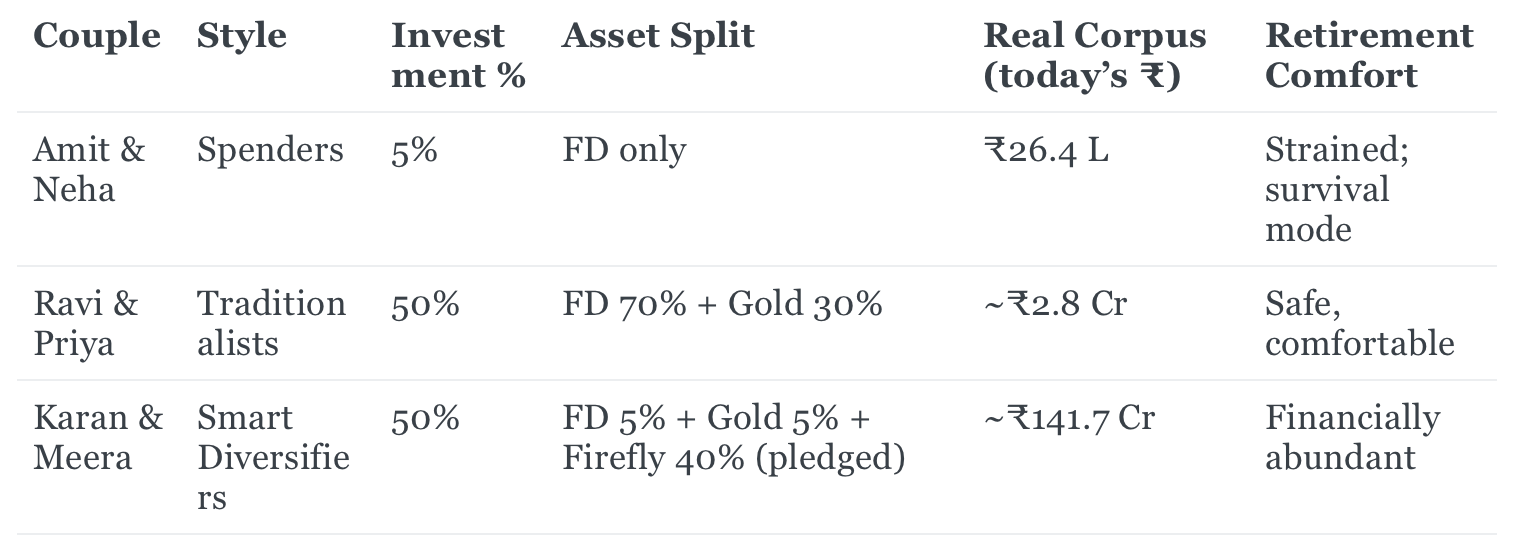

Amit & Neha — The Spenders

- Invest only 5% of income (FDs only).

- Lifestyle-first, savings last.

- Outcome at 60: ~₹26.4 lakh (real value).

- Lifestyle at 60: Strained. Likely dependent on children.

Ravi & Priya — The Traditionalists (50% investors)

- Invest 50% of income → 70% in FDs, 30% in gold.

- Buy a ₹40L vacation home at 40.

- Outcome at 60: ~₹28.0 crore nominal; ~₹2.8 crore real (inflation-adjusted).

- Lifestyle at 60: Safe and steady. Comfortable healthcare, some leisure travel, modest financial freedom.

Karan & Meera — The Smart Diversifiers (50% investors, pledging with Firefly)

- Invest 50% of income → FD 5%, Gold 5%, Firefly 40%.

- They don’t just invest in equity — they pledge it.

💡 How pledging works:

- Equity grows over time.

- The same equity can be pledged with a broker for margin.

- Firefly uses that margin to run strategies, so the same equity grows and also generates additional trading profits.

- Like owning a home that goes up in value while also earning rental income.

- Firefly sleeve (hypothetical 35% CAGR): A high-growth engine, compounding for 35 years.

- Outcome at 60: ~₹1,417 crore nominal; ~₹141.7 crore real (inflation-adjusted).

- Lifestyle at 60: Transformational wealth. Multi-generational legacy, world-class healthcare, leisure without compromise.

Side-by-Side Comparison

Lifestyle Lens: What These Numbers Mean at 60

- ₹26 Lakh (Amit & Neha – Spenders)

- Covers only basic living costs for 3–4 years of retirement.

- Healthcare costs alone could wipe this out.

- Heavy reliance on children or pensions.

- ₹2.8 Crore (Ravi & Priya – Traditionalists)

- Covers 20–25 years of basic retirement lifestyle with healthcare buffer.

- Travel and luxury limited.

- Safe but not abundant.

- ₹141 Crore (Karan & Meera – Smart Diversifiers)

- Enables a truly abundant lifestyle: world-class healthcare, property upgrades, travel, hobbies.

- Multi-generational security (children and grandchildren).

- Ability to leave a legacy fund or philanthropy corpus.

Key Insights

- Savings rate is the foundation. Without 50% commitment, the compounding gap never opens up.

- Conservative investing builds safety, not abundance. Ravi & Priya prove you can retire secure but not wealthy.

- Pledging multiplies compounding. Firefly lets equity work twice: compounding + trading profits.

- Inflation destroys nominal illusions. What looks like crores shrinks fast in today’s value.

- Wealth preservation at 60 is non-negotiable. Glide into safer assets to lock in the gains.

Final Word

Same salaries. Same EMIs. Same homes.

But three completely different retirements:

- Strained survival with ₹26 lakh.

- Safe comfort with ₹2.8 crore.

- Transformational freedom with ₹141 crore.

👉 Don’t be Amit & Neha.

👉 Don’t settle like Ravi & Priya.

✅ Be Karan & Meera — save big, pledge smart, and let disciplined automation like Firefly amplify your compounding.

🔥 Ready to explore disciplined, automated investing?

👉 See how Firefly works

Additional Resources

- 📘 Docs: docs.firefly.fintrens.com

- 📲 WhatsApp Channel: Join here

- 🤝 Careers & Community: www.fintrens.com/join

Disclaimer

This article is an educational illustration only. Returns, EMIs, and tax assumptions are hypothetical. Markets involve risk of loss. The Firefly 35% CAGR figure is illustrative, not audited, and not indicative of future results. Please consult a financial adviser/CA before investing.