This Trading Bot Outperformed 99% of Fund Managers (And It's Not What You Think)

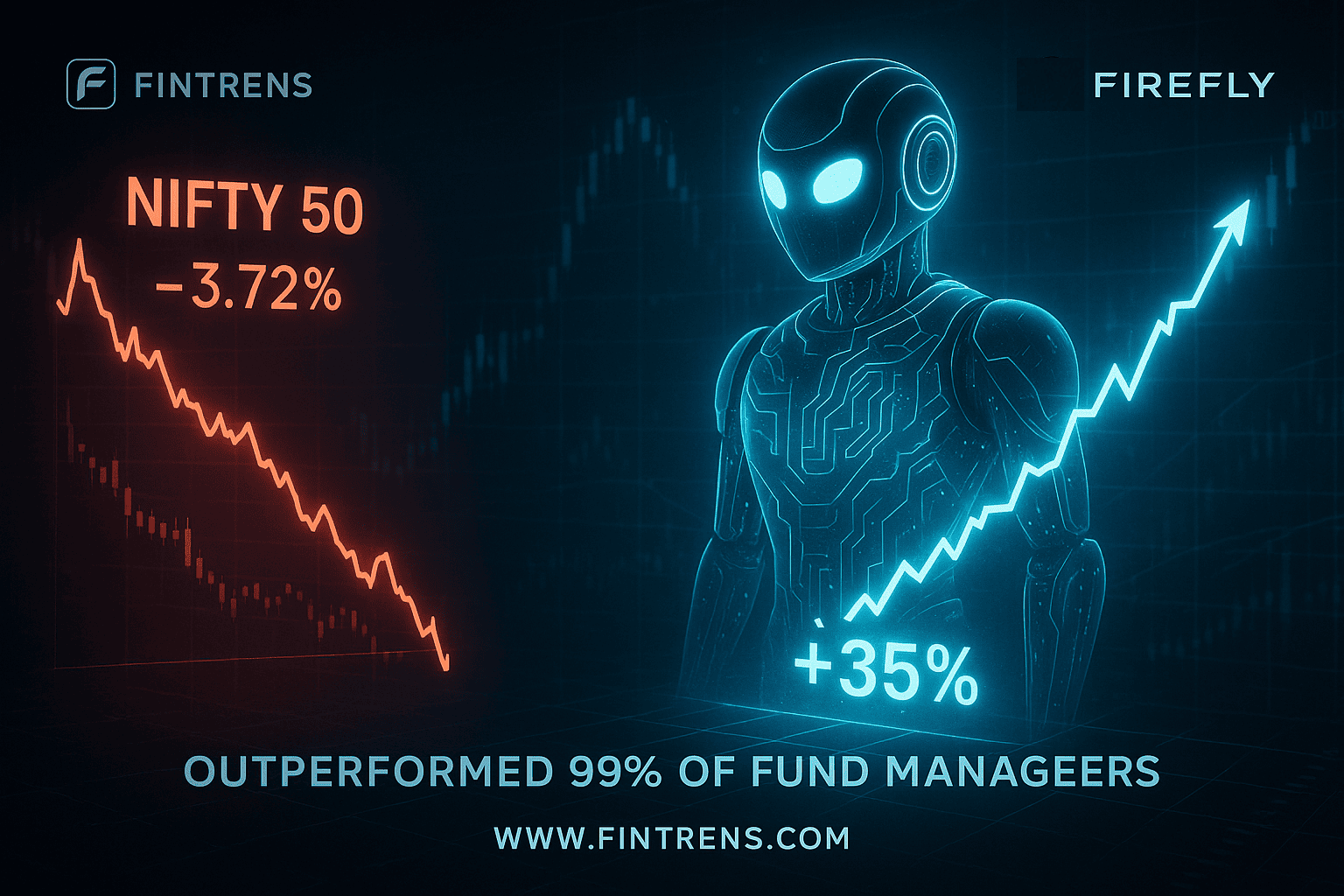

The Fall Everyone Saw, The Rise Nobody Expected

They said it was impossible—that beating the market during a decline was something only elite institutions could do. Yet while the NIFTY 50 index slipped –3.72% in the past year, investors using Firefly by Fintrens were quietly booking +35% returns.

And this isn’t backtested data. It’s realised P&L, generated in live accounts under SEBI’s regulated framework—proving that retail investors in India can now outperform 99% of fund managers.

Why Traditional Index Investing Falls Short

Most retail investors stay parked in NIFTY 50 or ETFs like NIFTYBees. But the cracks are obvious:

- 📉 Limited upside in sideways markets

- ❌ No protection during downturns

- 💸 Idle capital sitting unused

- ⏳ Inflation slowly eroding wealth

Fund managers face the same limitations, which is why so few of them beat the index. Firefly changes that equation.

The Engine: Stock Pledging + Algorithmic Automation

🔑 What is Stock Pledging?

Stock pledging lets you unlock additional trading capital without selling your core holdings.

- Pledge your Equity/ETFs/MF units

- Receive 50–90% margin money from your broker

- Deploy that capital via Firefly’s algo bot

- Keep your original holdings intact

This way, your money works twice as hard—your Equity/ETFs/MF remains invested, and the pledged margin is generating alpha through automation.

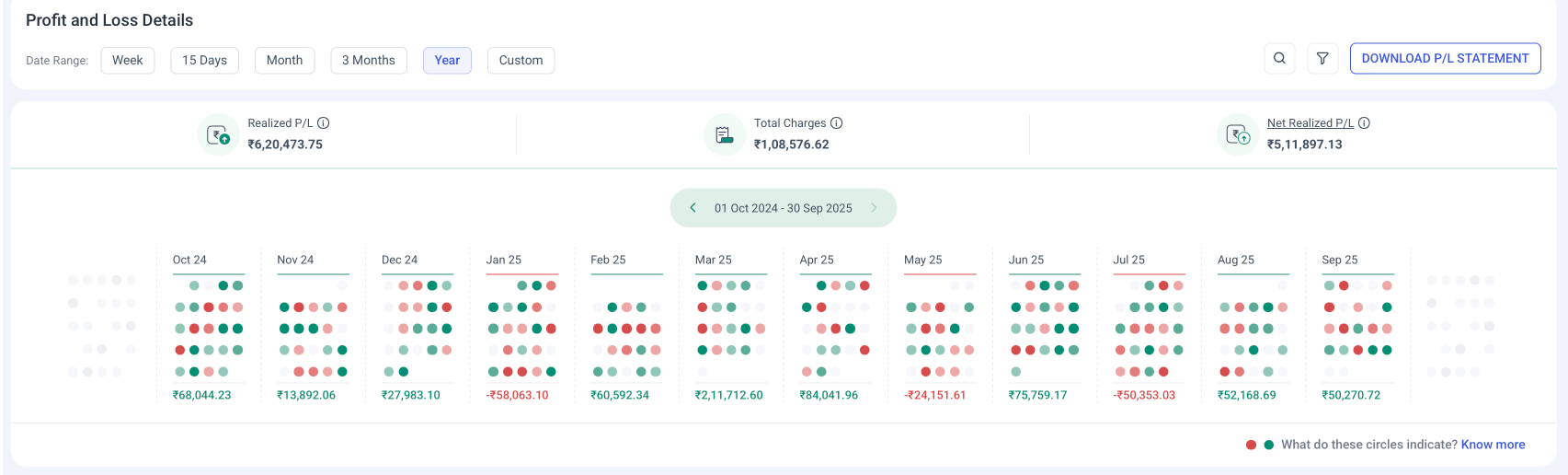

Proof of Performance: Realised P&L vs NIFTY

This is not theory. Here’s the actual realised P&L from a Firefly-linked account over the last 12 months:

- Capital Invested: ₹15,00,000 (in NIFTYBees for safety & pledging)

- Gross Realised P&L: ₹6,20,473.75

- Total Charges (brokerage, taxes, fees): ₹1,08,576.62

- Net Realised P&L: ₹5,11,897.13

That’s a net gain of ~34% on capital—even after all costs.

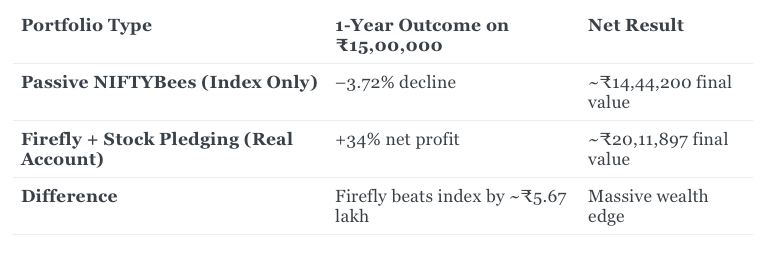

Benchmark Comparison: NIFTY vs Firefly

In the same period, the NIFTY 50 declined –960.60 points (–3.72%):

➡️ While NIFTY investors lost money, Firefly’s algo-pledging strategy delivered a ₹5.11L net profit on ₹15L capital.

Side-by-Side: Wealth Outcomes

How Firefly Works: Inside the Engine

Firefly isn’t just another trading bot—it’s a complete automated trading ecosystem designed for Indian markets under SEBI’s retail algo framework.

1. Risk Management Engine

- 24/7 monitoring of your portfolio to ensure capital protection

- Automated exposure limits and position sizing

- Indicator-based checks to prevent over-leverage

2. Quick Execution Engine

- Lightning-fast order placement via APIs for best fills

- Auto order sizing adapts to your capital and volatility

- Prevents unwanted or duplicate trades

3. Strategy Diversity (~30 Models)

- 📈 Mean reversion, momentum, volatility strategies

- 🚫 Loss positions cut quickly, profits allowed to run longer

- 🔄 Market condition triggers → only the right strategies activate

4. Multi-Segment Coverage

- Equities & Derivatives → Retail-friendly strategies

- Commodities → Extra diversification & profit opportunities

- Pro Trading strategies → Stable returns with minimal drawdowns

5. Portfolio-Based Tiers

- 💼 Under ₹50 Lakhs → Aggressive profit focus, ~9% drawdown

- 🏦 ₹50 Lakhs+ portfolios → Aggressive profit with ~3–4% drawdown

- 🧑💼 Prop models → Ultra-stable with ~2% drawdown

6. Adaptive by Design

- Firefly continuously shuts off underperforming strategies

- Ensures capital always flows to the highest-probability trades

👉 In short: Firefly combines risk-first automation, adaptive strategies, and execution speed to consistently deliver alpha retail investors can’t get elsewhere.

Risk You Must Know (Margin Calls & Forced Liquidation)

Leverage magnifies both profits and risks. With pledging:

- ⚠️ Margin Call: If holdings fall below broker’s maintenance margin

- 📉 Forced Liquidation: Broker can sell pledged shares.

👉 Firefly mitigates these with portfolio sizing, diversification, and risk dashboards.

Firefly is SEBI-Framework Ready

- ✅ OPS Limit Compliant

- ✅ Full transparency & audit trails

Why Now is the Perfect Window

- 📈 Volatility = opportunity

- 💡 Fintech adoption at all-time high

- ✅ SEBI support for retail algo adoption

- ⏳ Early adopters gain edge before strategies commoditise

How to Get Started

- Portfolio Assessment → Check pledging eligibility

- Broker Integration → Link with your existing brokers

- Firefly Setup → Configure strategies & risk levels

- Go Live → Monitor results in real-time

👉 Start now: www.fintrens.com/join

FAQs

Q1. Is stock pledging safe?

Yes—under SEBI’s margin pledge system, shares remain yours. The only risk is margin calls if market falls sharply.

Q2. Do I lose ownership of my NIFTYBees?

No. You retain ownership, they’re just used as collateral.

Q3. How does Firefly differ from mutual funds?

Mutual funds are managed by humans—often slow, emotional, and subject to high fees. Firefly, on the other hand:

- ✅ Uses ~30 live algo strategies running 24/7 with no human bias

- ✅ Delivers lower drawdowns with strict risk management

- ✅ Generates superior, consistent returns compared to most funds

But here’s the game-changer:

Firefly doesn’t just replace your mutual fund—it can pledge your existing mutual fund holdings and deploy that capital in trading strategies.

👉 Example: If your mutual fund generates 15% return in a year, Firefly can add another ~35% through pledged margin trading. That means your total effective return could be ~50% annually—a structural advantage traditional fund managers can’t match.

Conclusion: Don’t Let Your Wealth Sit Idle

While the NIFTY 50 lost –3.72%, Firefly by Fintrens turned ₹15L capital into a ₹5.11L net profit in just one year.

This is not speculation—it’s smart investing automation designed for retail India.

👉 Join Firefly Today

👉 Docs: docs.firefly.fintrens.com

👉 WhatsApp Channel: Click Here

Disclaimer

Past performance is not indicative of future results. Margin trading carries risk of loss, including forced liquidation. Consult your advisor before investing.

About Fintrens

Fintrens is India’s leading WealthTech platform, building AI-powered trading automation for retail investors. Our flagship Firefly trading bot helps users combine stock pledging with algo strategies to achieve institutional-grade returns.