We Only Place 10 Trades a Day — Here’s Why Firefly Outperforms Bots That Place 200+

“How many orders do you place per day?”

A client recently threw this question at me — and it’s one every trader secretly wonders.

I replied, “Roughly 10 a day.”

He looked puzzled. “Show me a month in your trading account that made 200+ orders per day.”

I opened September.

It had less than 125.

He asked again, “Why so few?”

And that’s when I revealed the secret recipe of Firefly by Fintrens.

🚀 Firefly Doesn’t Chase Orders — It Chases Profits

In a market where most algo platforms celebrate order counts, Firefly celebrates outcomes.

It’s not designed to trade more — it’s designed to earn more.

Every decision Firefly makes is powered by data, probability, and something unique we call Swarm Intelligence.

👉 Curious how Firefly analyses the market in real time? Explore →

⚙️ The Three Buckets of Firefly Strategies

Firefly’s logic engine categorises strategies into three smart buckets:

- 🪙 Less than ₹50 L capital — conservative, volatility-filtered setups

- 💼 More than ₹50 L capital — advanced, high-probability multi-leg systems

- 🧠 Prop-trading strategies — institution-grade models with dynamic leverage

Let’s zoom into the second one.

It holds 30 + active strategies, yet sometimes fires just a handful of orders — and sometimes dozens.

Why the variance? Because Firefly is market-aware.

🧭 How Firefly Knows When Not to Trade

Traditional algos keep firing orders whether the market is right or wrong.

Firefly doesn’t.

- In bullish markets, all bearish and neutral bots sleep.

- In sideways markets, directional bots rest.

- When volatility spikes, Firefly’s risk engine auto-sizes exposure before a human could even blink.

That’s how Firefly protects capital while staying ready to strike when probability turns in its favour.

📈 The Stepping Process — Scaling Winners Intelligently

When Firefly identifies a promising move, it starts small.

Once the market confirms direction, it adds more lots automatically — a process we call Stepping.

“If the data proves it right, it doubles down. If wrong, it exits fast.”

This intelligent scaling explains why order counts fluctuate — not every day deserves equal aggression.

🛡️ Auto-Sizing & Risk Management — The Real Brain Behind Firefly

Firefly’s auto-sizing engine continually adjusts trade quantity based on real-time volatility and risk probability.

- Low volatility → smaller quantities, fewer orders

- High conviction → larger quantities, more orders

Every parameter — from per-order profit/loss to portfolio-level drawdown — is dynamically recalculated.

Result: Stable returns with dramatically lower drawdowns.

🧮 Mathematics + Swarm Intelligence = Smart Profits

At its core, Firefly is a probability-driven mathematician that learns from collective market data.

This is Swarm Intelligence — multiple independent strategies acting like a colony of ants:

each evaluating direction, momentum, and volatility, then deciding collectively whether to attack or rest.

In short, the market drives Firefly, not the other way around.

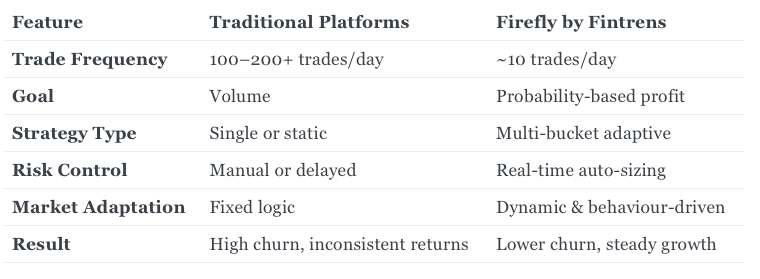

📊 Firefly vs Traditional Algo Platforms

💡 So… Do All These Mean 100% Accuracy?

No algo system can promise perfection — and neither do we.

Firefly’s average trade accuracy is about 45%.

But here’s the twist:

Those 45 % winning trades are held longer, while losing ones are cut quickly.

For instance:

- 3 losing trades = –₹15,000

- 2 winning trades = +₹25,000

- Net = ₹10,000 profit despite 40 % win rate

That’s the mathematical edge that’s delivered roughly 40 % average portfolio growth over the past two years.*

*Past performance doesn’t guarantee future results. All trading involves risk.

💬 Client Success Snapshot

“I switched from a platform that made 300 trades a day. Firefly cut that to under 100 a month — and my portfolio finally grew 30 % in six months.”

— Algorithmic Trader, Mumbai

Join 500 + traders across India who now choose intelligence over impulse.

🧠 Common Misconceptions

❓Won’t I miss opportunities with fewer trades?

No — you’ll miss unnecessary risks. Firefly filters noise and targets high-probability setups only.

❓Is Firefly sleeping when it’s not trading?

No. It’s watching — waiting for market behaviour alignment before acting.

🧭 Why It Works

Firefly’s success formula =

Discipline + Data + Dynamic Adaptation.

It doesn’t try to outsmart the market — it learns from it.

That’s how Firefly consistently delivers sustainable, risk-balanced returns.

✅ Ready to Trade Smarter, Not Harder?

Start with zero setup fees and a verified algo platform built for Indian markets.

🔥 Start Trading with Firefly Today — Free Setup Included →

💬 Join 2,000 + traders on WhatsApp for daily insights →

📘 Learn more at docs.firefly.fintrens.com