Why I Trust an Algorithm with My Retirement (And Why You Probably Shouldn’t Yet)

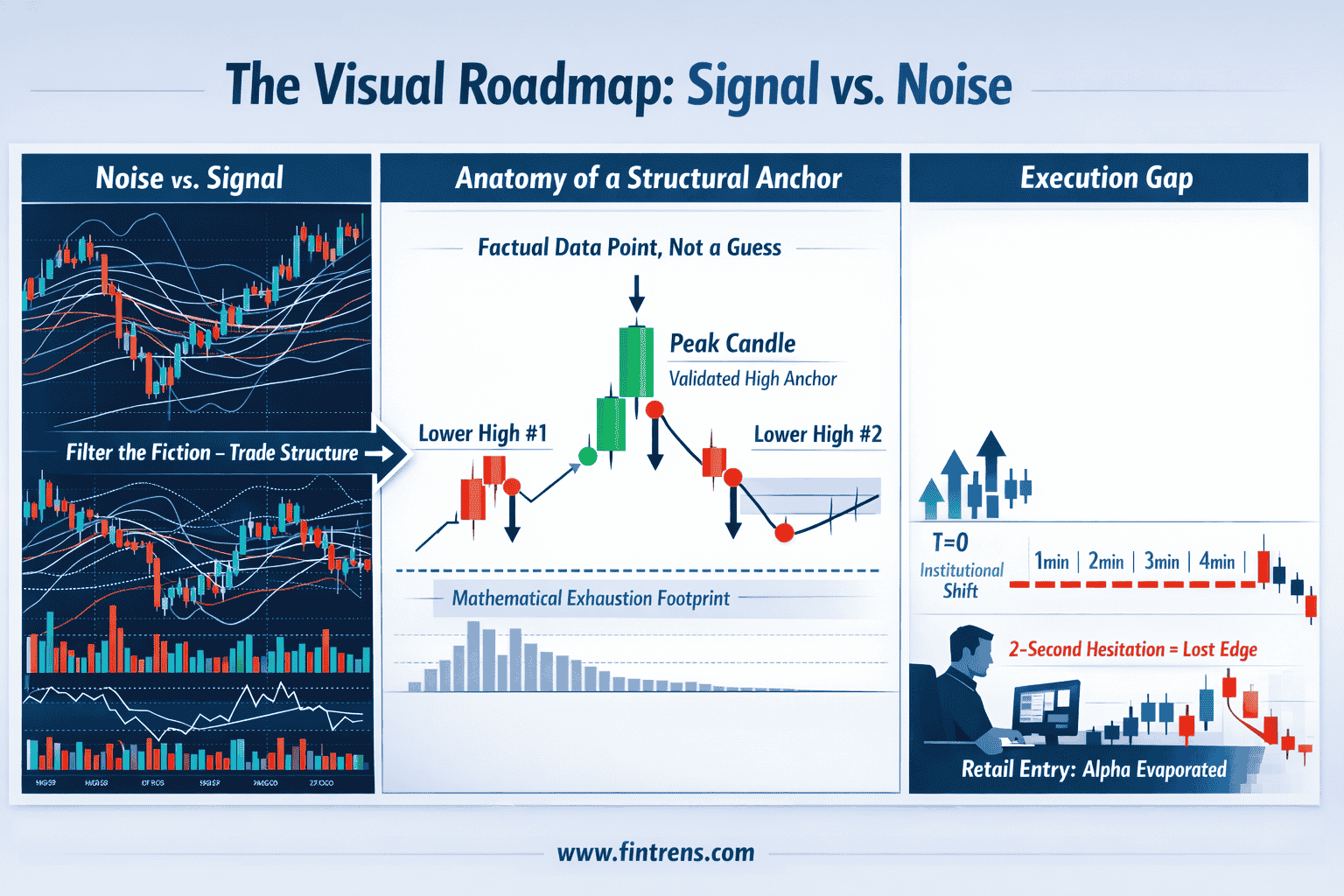

The first time I considered letting a piece of code manage my life savings, I felt like I was betraying my own common sense. We’re raised to believe that "hard work" and "keeping a close eye on things" are the only paths to financial security. For years, my morning ritual was the same: I’d wake up, open a dozen tabs of flickering stock charts, and try to "feel" where the market was going. I honestly believed that if I stared at those red and green candles long enough, I thought I could outsmart the world. By early 2026, I had to face a painful truth: I wasn't an investor; I was a nervous wreck. My instincts were actually my biggest financial liability.

The Problem Isn’t Your Brain—It’s Your Biology

The reason most of us struggle with investing isn't that we aren't smart. It’s that we are human. Our brains evolved to help us survive predators in open fields, not to process thousands of data points in a high-speed digital market. We have two "biological bugs" that often ruin our portfolios:

* The Panic Button: When the market drops, your brain sends a signal of physical danger. That "pit in your stomach" feeling makes you want to sell everything at the exact moment prices are lowest.

* The Greed Trap: When prices skyrocket, your brain releases dopamine. You feel "left out," which leads to "FOMO buying" at the very top, right before a correction.

I realized my portfolio wasn't being driven by logic; it was being driven by my nervous system. An algorithm, on the other hand, doesn’t have a pulse. It doesn’t get tired, it doesn’t have an ego, and it doesn't care about "feeling lucky." It just follows the rules.

The Power of Automation in a Modern Market

Today, automation is no longer just a luxury for Wall Street; it is the most effective tool we have to achieve true financial discipline. When we embrace automation, we aren't "giving up"—we are leveling up. We are using technology to do what the human brain wasn't designed for: maintaining 24/7 focus and executing a plan with zero emotional interference.

The beauty of a well-constructed automated system lies in its ability to bring three major advantages to your retirement strategy:

* Unwavering Consistency: While a human might miss a trade because they were tired or distracted, automation executes the strategy perfectly every single time. This consistency is what turns a "lucky streak" into a long-term, repeatable process.

* Complex Data Processing: The modern market moves at the speed of light. Automation can scan thousands of data points—from price action to volume trends—across multiple sectors in milliseconds. It provides a "birds-eye view" of the market that no amount of manual chart-watching could ever match.

* Mathematical Discipline: An automated system doesn't "hope" for a bounce. It operates on math. By setting clear parameters for risk and reward, automation ensures that every decision is backed by data, giving you the peace of mind to step away from the screen.

When used correctly, automation is the ultimate partner for a long-term investor. It takes your best logical intentions and turns them into a tireless, digital employee that never sleeps.

Finding a Systematic Way Forward

I didn't just flip a switch and hope for the best. I spent years looking for a way to prioritize capital preservation (keeping what I have) over making money quickly. This obsession with logic over emotion is exactly why we developed Firefly at Fintrens. Firefly is the culmination of everything I learned about the power of systematic trading. It is a transparent, logic-first engine designed to navigate the market with the discipline that our biology lacks. I use it for my own capital because I want to know exactly how I'm being protected when things go sideways. It’s not about finding a "magic" solution; it’s about having a tireless system that follows the math, even when the rest of the world is panicking.

If you’re tired of the "chart-watching" burnout and want to see what a professional-grade automated approach looks like, I invite you to see the work we’re doing with Firefly.

The 3 Indicators I Use to Stay Safe

To transition from emotional trading to systematic investing, you need filters that tell you when the "statistical weather" is too dangerous for your capital. Here are the three indicators I trust to keep me out of trouble:

1. The Volatility Regime (VIX)

In the investing world, volatility isn't just movement; it's a measure of fear. I monitor the VIX (Volatility Index). When the VIX is low, the market is "efficient" and calm. When it spikes above 20 or 25, it indicates that the "biological bugs" of panic are taking over the masses. My rule is simple: if the volatility is too high, the algorithm stays on the sidelines. We don't try to be heroes in a hurricane.

2. Trend Correlation & Moving Averages

Many retail investors lose money by "buying the dip" on a stock that is actually in a death spiral. I use long-term moving averages (like the 200-day) to determine the overall health of the market. If the price is trading below this line, the trend is fundamentally bearish. An algorithm doesn't care how "cheap" a stock looks; it only cares if the trend is in its favor. We only swim with the current, never against it.

3. Market Breadth (The Participation Filter)

This is perhaps the most important safety net. A "fake" rally happens when only a few giant stocks are going up while the rest of the market is quietly dying. By looking at "Breadth"—the number of individual stocks advancing versus declining—we can see the true strength of the market. If the index is hitting new highs but breadth is falling, it’s a warning sign that the floor is about to drop out. We wait for the "whole army" to move together before we commit.

Moving Forward with Discipline

By combining these three metrics, we remove the need for instincts. We aren't guessing what will happen tomorrow; we are measuring what is happening right now and reacting with surgical precision. This is the difference between gambling on a "hunch" and managing wealth like a professional.

It’s time to stop guessing and start governing your wealth with data.

Want to see Firefly in action?

Start → https://www.fintrens.com

Docs → https://docs.firefly.fintrens.com

Updates → https://whatsapp.com/channel/0029VackYjRLdQegrpD4uj2T

Join now → https://www.fintrens.com/join

Disclaimer: The information provided is for educational purposes only and should not be construed as financial, investment, or trading advice. Investing in financial markets involves substantial risk, including the potential loss of principal. Any references to algorithms, indicators, or performance are illustrative and not guarantees of future results. Users should conduct their own due diligence and consult with a qualified financial professional before making any investment decisions.