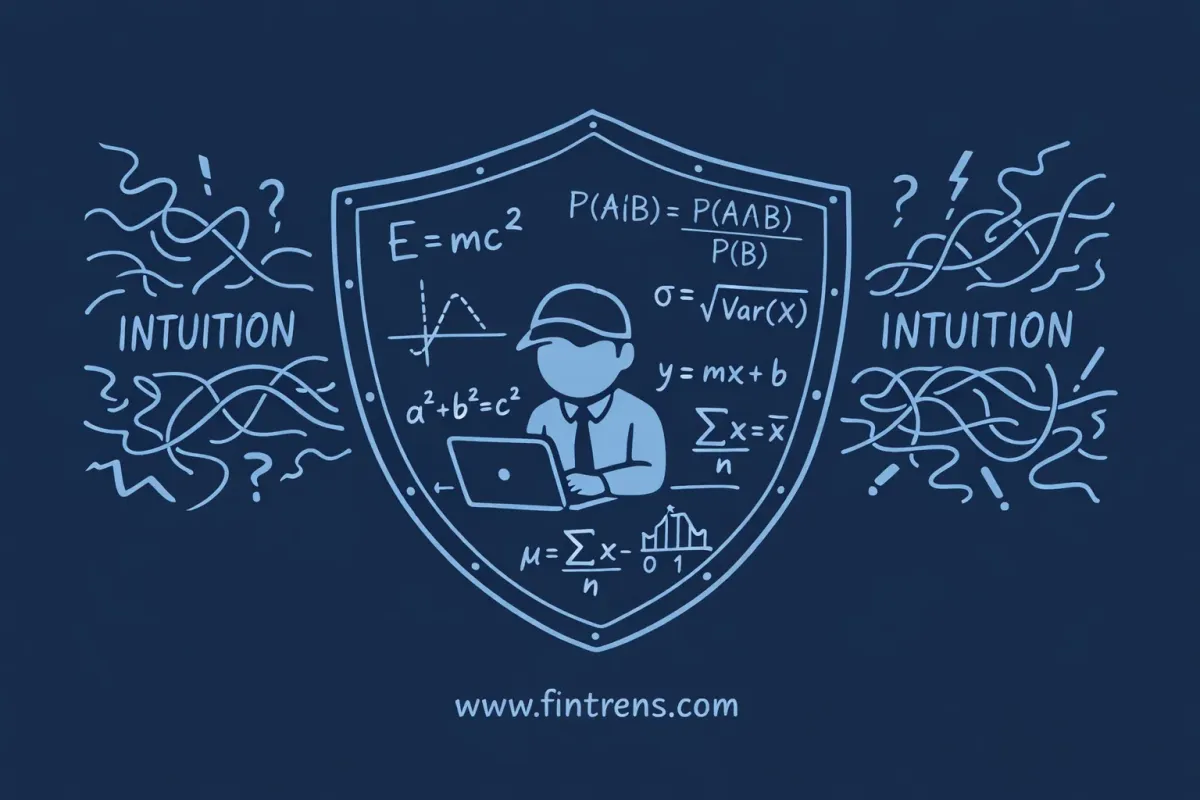

Why Mathematics Must Replace "Intuition"

Traditionally, the "top-tier" trader was seen as a bold expert who relied on a special talent for reading the market—someone who could watch the numbers flash on a screen and just "know" a big move was coming. While this image of a lone expert "feeling" the market's pulse was popular for a long time, it simply doesn't hold up in 2026. The sheer volume of information being generated every second has far surpassed what any human brain can handle. To survive in this environment, a trader needs to move beyond looking at simple visual patterns on a chart and start relying on mathematical probability. This isn't just about being "smart"; it’s about acknowledging that the human mind wasn’t built to track thousands of global data points and complex connections in a fraction of a second.

In today's world, relying on a "feeling" is essentially gambling against the odds. The market has become a high-speed digital ecosystem where algorithms make decisions based on hard data before a human can even process what they are seeing. If you are still trying to trade by spotting a "shape" on a graph, you are missing the invisible forces—like interest rate shifts, changes in supply and demand, and global news—that actually drive prices. To find a real advantage, you have to shift from being someone who guesses to someone who calculates. The goal is simple: stop wondering where the price might go based on a hunch and start looking at what the math says is most likely to happen.

Multi-Dimensional Analysis: Looking at the Whole Picture

Most retail traders fail because they look at the market in only two dimensions. They see a "support line" on a chart and assume the price will bounce. But in a world driven by AI, a simple line on a graph isn't enough information. To find a true edge, you must analyze three pillars simultaneously:

* Volatility: Is the price moving because of a genuine change in value, or is it just "noise"? Mathematical models allow us to see through the chaos, helping us ignore the fake moves that often trap manual traders.

* Volume Profile: This shows you the specific price levels where the "Big Money" is actually trading. While a regular chart shows you where the price went, the volume profile shows you where the actual power is sitting.

* Cross-Asset Correlation: In 2026, no asset exists on its own. A shift in interest rates in one country or a spike in oil prices can impact a tech stock thousands of miles away in seconds. If you aren't looking at how these different pieces move together, you are trading with a blindfold on.

Dynamic Risk: Adjusting to the Market’s Heat

Conventional financial literature often taught a simple rule: "Always risk 1% or 2% of your account per trade." While that sounds disciplined, it’s actually quite basic for the modern era. In 2026, successful trading requires Dynamic Risk Management.

This means your position size shouldn’t be a fixed number; it should change instantly based on real-time market "heat." If the market is calm and the math shows a high chance of success, the system scales in. If things get wild and unpredictable, the system automatically shrinks your trade size to protect your money. A human trader, often influenced by the fear of missing out or the stress of a loss, rarely has the emotional control to make these calculations perfectly in the middle of a trade.

Non-Stop Monitoring: A Global Domino Effect

The market is now a 24/7 global machine that never stops. Because everything is connected, a small event in one part of the world can start a domino effect everywhere else. A news headline in London at 3:00 AM can trigger a sell-off in Mumbai before you’ve even woken up.

Human biology is a natural limit. We need sleep, we need to eat, and we lose focus after a few hours of staring at screens. But the market doesn't care about our schedule. If your strategy relies on you being awake to click a button, you are at risk of the "overnight gap"—that moment you wake up to find the market has moved significantly against you while you were asleep. To compete today, you need a way to watch the data every single second.

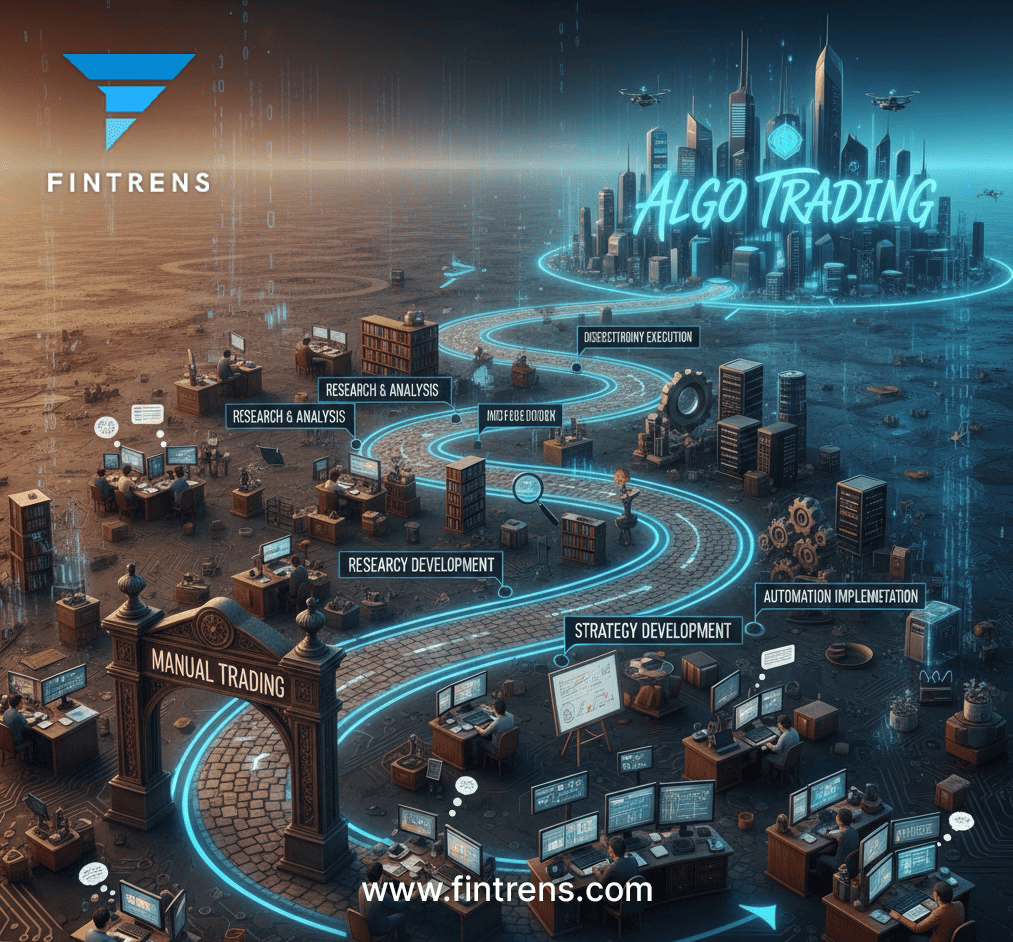

The Path Forward: Automation is the Minimum Requirement

There was a time when just having a computer gave you an advantage. Then, having fast internet was the edge. Today, those are just the "table stakes"—the bare minimum you need just to get started.

In 2026, the real advantage comes from delegated execution. Trading manually in a market dominated by high-speed AI is like trying to win a Formula 1 race on a bicycle. You might be the best cyclist in the world, but the physics of the race are against you. You need a system that processes data at the speed of the market, not at the speed of human thought.

Explore Firefly by Fintrens

If you are tired of being "a step behind" the market, it’s time to change your approach. Our flagship algo trading bot, Firefly, was built to bridge the gap between high-end institutional technology and the individual investor.

Firefly doesn't rely on old, lagging indicators. Instead, it utilizes:

* Sophisticated Mathematical Models: It removes the "hope" and "fear" from trading, focusing purely on high-probability data.

* Swarm Intelligence: It monitors dozens of data points across global markets at the same time to ensure you are on the right side of the move.

Firefly removes the human bottleneck. It executes with mathematical precision while managing your risk 24/7. In a world of algorithms, don't be the one left pedaling a bicycle. It's time to trade at the speed of math.

See Firefly live:

- Get started:

https://www.fintrens.com - Read the docs:

https://docs.firefly.fintrens.com - Real-time updates: https://whatsapp.com/channel/0029VackYjRLdQegrpD4uj2T

- Join the community:

https://www.fintrens.com/join

Disclaimer: This article is for educational and informational purposes only and does not constitute financial, investment, legal, or tax advice. Trading and investing involve significant risk, including the potential loss of capital, and past performance (including any examples or model-based results) does not guarantee future outcomes. Any references to tools, automation, or “high-probability” methods—including Firefly by Fintrens—are not a promise of returns; results may vary due to market conditions, execution, liquidity, slippage, and other factors. Always do your own research and consult a qualified financial advisor before making investment decisions.